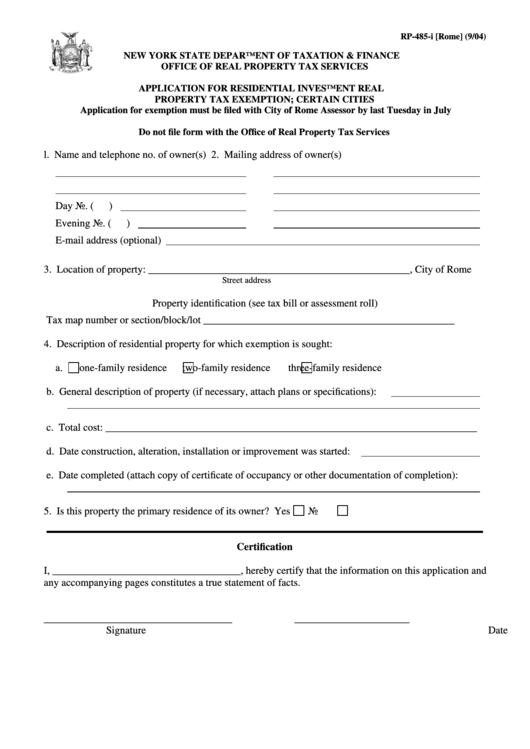

Form Rp-485-I - Application For Residential Investment Real Property Tax Exemption - Rome

ADVERTISEMENT

RP-485-i [Rome] (9/04)

NEW YORK STATE DEPARTMENT OF TAXATION & FINANCE

OFFICE OF REAL PROPERTY TAX SERVICES

APPLICATION FOR RESIDENTIAL INVESTMENT REAL

PROPERTY TAX EXEMPTION; CERTAIN CITIES

Application for exemption must be filed with City of Rome Assessor by last Tuesday in July

Do not file form with the Office of Real Property Tax Services

l. Name and telephone no. of owner(s)

2. Mailing address of owner(s)

Day No. (

)

Evening No. (

)

E-mail address (optional)

3. Location of property: __________________________________________________, City of Rome

Street address

Property identification (see tax bill or assessment roll)

Tax map number or section/block/lot ________________________________________________

4. Description of residential property for which exemption is sought:

a.

one-family residence

two-family residence

three-family residence

b. General description of property (if necessary, attach plans or specifications):

c. Total cost: _______________________________________________________________________

d. Date construction, alteration, installation or improvement was started:

e. Date completed (attach copy of certificate of occupancy or other documentation of completion):

5. Is this property the primary residence of its owner?

Yes

No

Certification

I, ____________________________________, hereby certify that the information on this application and

any accompanying pages constitutes a true statement of facts.

____________________________________

______________________

Signature

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2![Form Rp-485-i [rome] - Application For Residential Investment Real Property Tax Exemption; Certain Cities Form Rp-485-i [rome] - Application For Residential Investment Real Property Tax Exemption; Certain Cities](https://data.formsbank.com/pdf_docs_html/320/3209/320950/page_1_thumb.png)