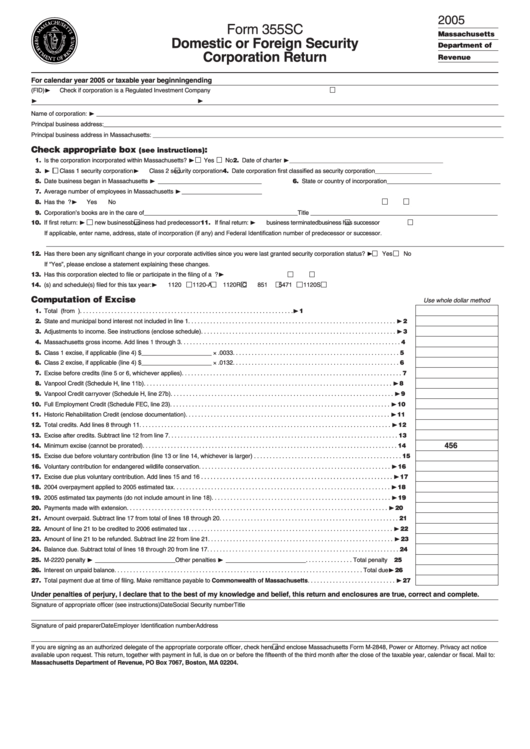

Form 355sc - Domestic Or Foreign Security Corporation Return - 2005

ADVERTISEMENT

2005

Form 355SC

Massachusetts

Domestic or Foreign Security

Department of

Corporation Return

Revenue

For calendar year 2005 or taxable year beginning

ending

‹¤

U.S. Principal Business Code

Federal Identification number (FID)

Check if corporation is a Regulated Investment Company

‹

‹

Name of corporation: ‹ __________________________________________________________________________________________________________________________

Principal business address: _______________________________________________________________________________________________________________________

Principal business address in Massachusetts: _________________________________________________________________________________________________________

Check appropriate box

:

(see instructions)

11. Is the corporation incorporated within Massachusetts? ‹

2. Date of charter ‹______________________________________________

Yes

No

13. ‹

‹

Class 1 security corporation

Class 2 security corporation

4. Date corporation first classified as security corporation _________________

15. Date business began in Massachusetts ‹ _______________________________

6. State or country of incorporation __________________________________

17. Average number of employees in Massachusetts ‹ ________________________

18. Has the U.S. government changed your taxable income for any prior year which has not yet been reported to Massachusetts? ‹

Yes

No

19. Corporation’s books are in the care of ______________________________________________ Title ________________________________________________________

10. If first return: ‹

11. If final return: ‹

new business

business had predecessor

business terminated

business has successor

If applicable, enter name, address, state of incorporation (if any) and Federal Identification number of predecessor or successor.

_________________________________________________________________________________________________________________________________________

12. Has there been any significant change in your corporate activities since you were last granted security corporation status? ‹

Yes

No

If “Yes”, please enclose a statement explaining these changes.

13. Has this corporation elected to file or participate in the filing of a U.S. consolidated return? ‹

Yes

No. FID of parent ________________________________________

14. U.S. form(s) and schedule(s) filed for this tax year: ‹

1120

1120-A

1120RIC

851

5471

1120S

Computation of Excise

Use whole dollar method

11. Total U.S. income (from U.S. Form 1120 or 1120-A) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ‹1

12. State and municipal bond interest not included in line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ‹2

13. Adjustments to income. See instructions (enclose schedule). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ‹3

14. Massachusetts gross income. Add lines 1 through 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

15. Class 1 excise, if applicable (line 4) $ _____________________ × .0033 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

16. Class 2 excise, if applicable (line 4) $ _____________________ × .0132 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

17. Excise before credits (line 5 or 6, whichever applies) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

18. Vanpool Credit (Schedule H, line 11b) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ‹8

19. Vanpool Credit carryover (Schedule H, line 27b) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ‹9

10. Full Employment Credit (Schedule FEC, line 23) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ‹10

11. Historic Rehabilitation Credit (enclose documentation) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ‹11

12. Total credits. Add lines 8 through 11. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ‹12

13. Excise after credits. Subtract line 12 from line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

456

14. Minimum excise (cannot be prorated). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

15. Excise due before voluntary contribution (line 13 or line 14, whichever is larger) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

16. Voluntary contribution for endangered wildlife conservation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ‹16

17. Excise due plus voluntary contribution. Add lines 15 and 16 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ‹17

18. 2004 overpayment applied to 2005 estimated tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ‹18

19. 2005 estimated tax payments (do not include amount in line 18) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ‹19

20. Payments made with extension . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ‹20

21. Amount overpaid. Subtract line 17 from total of lines 18 through 20 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21

22. Amount of line 21 to be credited to 2006 estimated tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ‹22

23. Amount of line 21 to be refunded. Subtract line 22 from line 21. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ‹23

24. Balance due. Subtract total of lines 18 through 20 from line 17 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24

25. M-2220 penalty ‹¤ ________________________ Other penalties ‹ ________________________ . . . . . . . . . . . . . . . Total penalty ‹25

26. Interest on unpaid balance. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Total due ‹26

27. Total payment due at time of filing. Make remittance payable to Commonwealth of Massachusetts . . . . . . . . . . . . . . . . . . . . . . . . . . . . ‹27

Under penalties of perjury, I declare that to the best of my knowledge and belief, this return and enclosures are true, correct and complete.

Signature of appropriate officer (see instructions)

Date

Social Security number

Title

Signature of paid preparer

Date

Employer Identification number

Address

If you are signing as an authorized delegate of the appropriate corporate officer, check here

and enclose Massachusetts Form M-2848, Power or Attorney. Privacy act notice

available upon request. This return, together with payment in full, is due on or before the fifteenth of the third month after the close of the taxable year, calendar or fiscal. Mail to:

Massachusetts Department of Revenue, PO Box 7067, Boston, MA 02204.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2