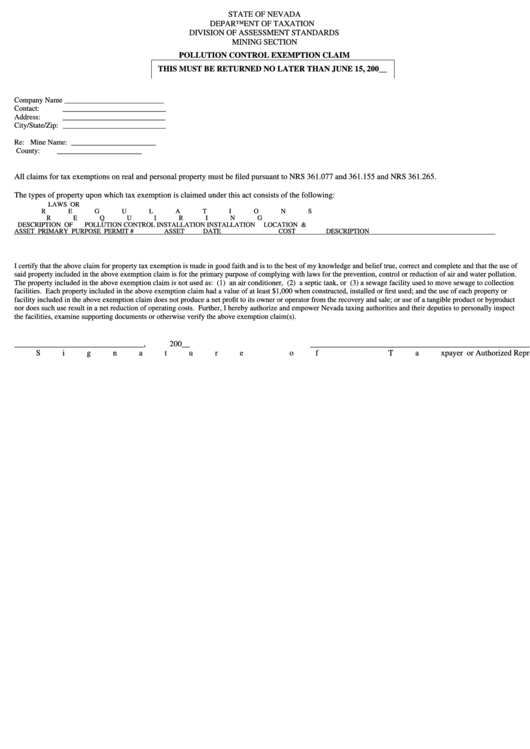

STATE OF NEVADA

DEPARTMENT OF TAXATION

DIVISION OF ASSESSMENT STANDARDS

MINING SECTION

POLLUTION CONTROL EXEMPTION CLAIM

THIS MUST BE RETURNED NO LATER THAN JUNE 15, 200__

Company Name ___________________________

Contact:

____________________________

Address:

____________________________

City/State/Zip: ____________________________

Re:

Mine Name: _______________________

County:

_______________________

All claims for tax exemptions on real and personal property must be filed pursuant to NRS 361.077 and 361.155 and NRS 361.265.

The types of property upon which tax exemption is claimed under this act consists of the following:

LAWS OR

REGULATIONS

REQUIRING

DESCRIPTION OF

POLLUTION CONTROL

INSTALLATION

INSTALLATION

LOCATION &

ASSET

PRIMARY PURPOSE

PERMIT #

ASSET

DATE

COST

DESCRIPTION

I certify that the above claim for property tax exemption is made in good faith and is to the best of my knowledge and belief true, correct and complete and that the use of

said property included in the above exemption claim is for the primary purpose of complying with laws for the prevention, control or reduction of air and water pollution.

The property included in the above exemption claim is not used as: (1) an air conditioner, (2) a septic tank, or (3) a sewage facility used to move sewage to collection

facilities. Each property included in the above exemption claim had a value of at least $1,000 when constructed, installed or first used; and the use of each property or

facility included in the above exemption claim does not produce a net profit to its owner or operator from the recovery and sale; or use of a tangible product or byproduct

nor does such use result in a net reduction of operating costs. Further, I hereby authorize and empower Nevada taxing authorities and their deputies to personally inspect

the facilities, examine supporting documents or otherwise verify the above exemption claim(s).

________________________________, 200__

_________________________________________________________

Signature of Taxpayer or Authorized Representative

1

1