Village Of Granville Income Tax Department Claim For Refund Form

ADVERTISEMENT

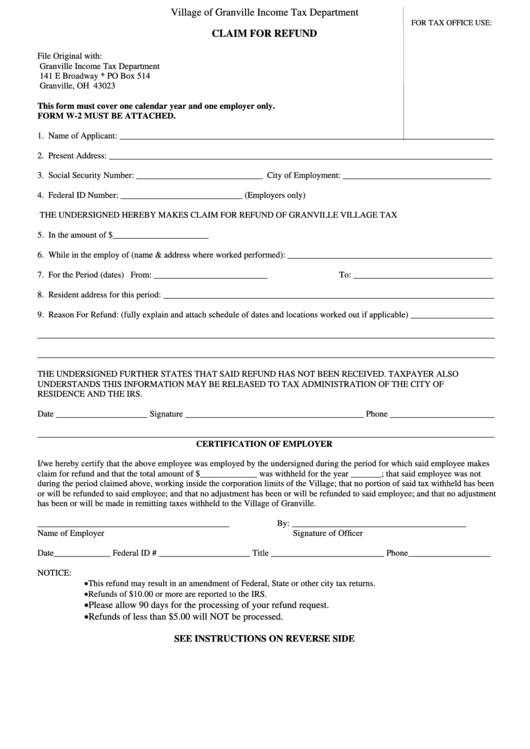

Village of Granville Income Tax Department

FOR TAX OFFICE USE:

CLAIM FOR REFUND

File Original with:

Granville Income Tax Department

141 E Broadway * PO Box 514

Granville, OH 43023

This form must cover one calendar year and one employer only.

FORM W-2 MUST BE ATTACHED.

1. Name of Applicant: ______________________________________________________________________________________

2. Present Address: ________________________________________________________________________________________

3. Social Security Number: _____________________________ City of Employment: __________________________________

4. Federal ID Number: ____________________________ (Employers only)

THE UNDERSIGNED HEREBY MAKES CLAIM FOR REFUND OF GRANVILLE VILLAGE TAX

5. In the amount of $______________________

6. While in the employ of (name & address where worked performed): _______________________________________________

7. For the Period (dates) From: __________________________

To: ________________________________

8. Resident address for this period: ____________________________________________________________________________

9. Reason For Refund: (fully explain and attach schedule of dates and locations worked out if applicable) ___________________

_________________________________________________________________________________________________________

_________________________________________________________________________________________________________

THE UNDERSIGNED FURTHER STATES THAT SAID REFUND HAS NOT BEEN RECEIVED. TAXPAYER ALSO

UNDERSTANDS THIS INFORMATION MAY BE RELEASED TO TAX ADMINISTRATION OF THE CITY OF

RESIDENCE AND THE IRS.

Date _____________________ Signature _________________________________________ Phone ________________________

_________________________________________________________________________________________________________

CERTIFICATION OF EMPLOYER

I/we hereby certify that the above employee was employed by the undersigned during the period for which said employee makes

claim for refund and that the total amount of $_____________ was withheld for the year _______; that said employee was not

during the period claimed above, working inside the corporation limits of the Village; that no portion of said tax withheld has been

or will be refunded to said employee; and that no adjustment has been or will be refunded to said employee; and that no adjustment

has been or will be made in remitting taxes withheld to the Village of Granville.

____________________________________________

By: ________________________________________

Name of Employer

Signature of Officer

Date_____________ Federal ID # _____________________ Title __________________________ Phone___________________

NOTICE:

•

This refund may result in an amendment of Federal, State or other city tax returns.

•

Refunds of $10.00 or more are reported to the IRS.

•

Please allow 90 days for the processing of your refund request.

•

Refunds of less than $5.00 will NOT be processed.

SEE INSTRUCTIONS ON REVERSE SIDE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2