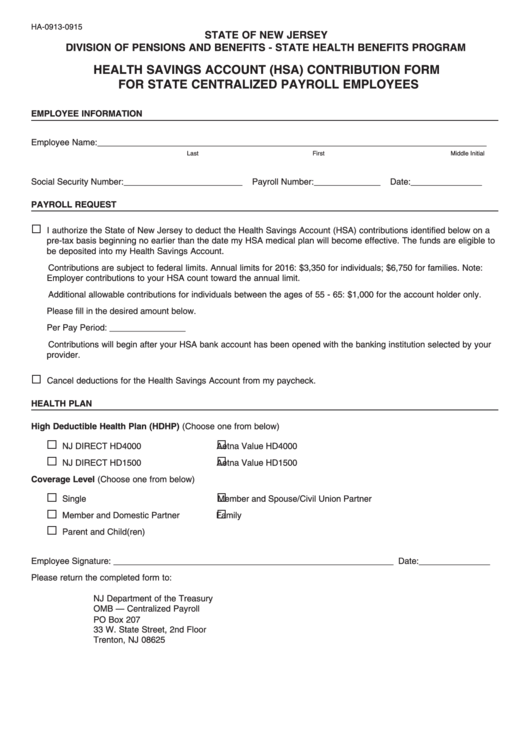

Health Savings Account (Hsa) Contribution Form For State Centralized Payroll Employees

ADVERTISEMENT

HA-0913-0915

STATE OF NEW JERSEY

DIVISION OF PENSIONS AND BENEFITS - STATE HEALTH BENEFITS PROGRAM

HEALTH SAVINGS ACCOUNT (HSA) CONTRIBUTION FORM

FOR STATE CENTRALIZED PAYROLL EMPLOYEES

EMPLOYEE INFORMATION

Employee Name: __________________________________________________________________________________

Last

First

Middle Initial

Social Security Number: _________________________

Payroll Number: ______________

Date:_______________

PAYROLL REQUEST

I authorize the State of New Jersey to deduct the Health Savings Account (HSA) contributions identified below on a

pre-tax basis beginning no earlier than the date my HSA medical plan will become effective. The funds are eligible to

be deposited into my Health Savings Account.

Contributions are subject to federal limits. Annual limits for 2016: $3,350 for individuals; $6,750 for families. Note:

Employer contributions to your HSA count toward the annual limit.

Additional allowable contributions for individuals between the ages of 55 - 65: $1,000 for the account holder only.

Please fill in the desired amount below.

Per Pay Period: ________________

Contributions will begin after your HSA bank account has been opened with the banking institution selected by your

provider.

Cancel deductions for the Health Savings Account from my paycheck.

HEALTH PLAN

High Deductible Health Plan (HDHP) (Choose one from below)

NJ DIRECT HD4000

Aetna Value HD4000

NJ DIRECT HD1500

Aetna Value HD1500

Coverage Level (Choose one from below)

Single

Member and Spouse/Civil Union Partner

Member and Domestic Partner

Family

Parent and Child(ren)

Employee Signature: ___________________________________________________________ Date: _______________

Please return the completed form to:

NJ Department of the Treasury

OMB — Centralized Payroll

PO Box 207

33 W. State Street, 2nd Floor

Trenton, NJ 08625

ADVERTISEMENT

0 votes

1

1