INFORMATION AND INSTRUCTIONS FOR COMPLETING THE FULL PAYMENT CERTIFICATE

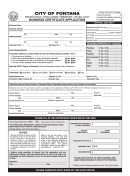

1. PREMISES INFORMATION

Premises Addresses(s): List address(es) of property. For Condominium or Townhouse, include the precise unit number.

Property Index Number(s): Provide all the P.I.N.s that are identified with the property address(es) listed. P.I.N.s may be obtained from the property tax bill or the Cook County

Assessor.

Water Account Number(s): Provide the City of Chicago Water Account numbers for the property address(es) listed if known.

CHECK ALL APPLICABLE: Check all categories which apply to the property. For example, if the property is a 5 unit Apartment Building on a corner, check both APT BLDG<6

UNITS and CORNER PROPERTY; if it is a single family dwelling for refinancing only, check SINGLE FAMILY HOME and REFINANCE ONLY; if it is a foreclosure property

transaction, check FORECLOSURE and TRANSFER TAX EXEMPT, etc.

CONDO/TOWNHOUSE/CO-OP, INDIVIDUALLY BILLED: Check box and circle the property type which applies if it has its own water service (not a member of an association).

CONDO/TOWNHOUSE/CO-OP, ASSOCIATION BILLED: Check box and circle the property type which applies if a formal Homeowner’s Association exists and members pay

their water bill through the Association. Further: (a) If the Association’s account reflects no past due balance, an FPC will be issued without additional documentation; (b) if the

Association’s account reflects a past due balance, a formal “Paid Assessment Letter” is required. The Association balance may be obtained by calling (312) 744-4426, selecting

the “Billing and Payment” option, and entering the water account number.

TRANSFER TAX EXEMPT: Check this box if the property transfer is exempt from the CITY OF CHICAGO Real Property Transfer Tax Stamp (Municipal Code 3-33-070) and

indicate in the blank the exact code letter found on Page 2 of the Real Property Transfer Tax (RPTT) Declaration (form 7551) which describes the appropriate category for

the property exemption. Contact the Department of Finance Tax division for more information concerning exemptions. The FPC fee is waived if the subject property is exempt from

the City of Chicago Real Property Transfer Tax.

2. SUPPORTING DOCUMENTATION

Check the document category that corresponds to the property or transaction type listed and submit the required document(s) with the application. For NEW CONSTRUCTION,

REHABS AND CONDO CONVERSIONS: a) All necessary plumbing permits must be obtained; (b) the Meter(s) must be set by a licensed, bonded plumbing contractor; (c) the

Meter(s) must be “controlled” by the Meter Shop – necessary arrangements may be made by calling (312) 747-2862. A property that is in the hands of a developer is not treated

as a condo until 75% of the units have been sold.

SPECIAL NOTE: In addition, it is possible that after field review, properties not listed in the documentation categories may still require additional documents, such as Legal

descriptions and/or Plats of Survey to be submitted in order for the application to be processed.

3. SCHEDULE METER READING

Provide the necessary information if the property has a metered water service and there has not been a meter reading within the last 60 days. Applications requiring a meter read

should be submitted well in advance of the closing date.

Name/ Local Daytime Phone: Provide the name and local phone of a contact person who can provide access to the property so that a meter reading can be taken. This person

must be available to provide access on the scheduled reading date between the hours of 7 AM and 3:30 PM.

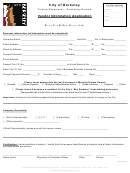

4. BUYER INFORMATION

Provide the name of the buyer, current contact phone and email address. Provide name of buyer’s attorney and phone number. Under BUYER REQUESTS FUTURE BILLS

BE MAILED TO, provide the exact address to which the buyer wishes the bills to be mailed. Clearly indicate if bills are to be sent in care of (c/o) a party or entity other than the

buyer.

5. SELLER INFORMATION

Provide the name of the seller, current address, contact phone and email address. Provide the name of the seller’s attorney and contact phone.

6. PREPARER INFORMATION

Provide the name of the person and the company or firm they represent who is preparing the application, address, contact phone and email address.

7. ACKNOWLEDGEMENT

Applicant must print name, sign and indicate the relationship to the transaction (seller, buyer, preparer, attorney, etc.).

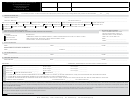

ADDITIONAL INFORMATION:

FPC applications for Foreclosures, Tax Deeds, HUD properties, VA properties or Receiverships and requests related to Bankruptcies, Lien Releases and Payoff Letters must be directed

to the FPC Legal Services unit- PHONE: (312) 747-8051. FAX (312) 747-6894.

FPC APPLICATIONS BY FAX: Fax all applications to: (312) 747-8321.

Faxed-In applications must include all necessary documentation as specified on the application. When faxing a legal description, an address must be written on the legal document.

Once the application is processed, it will be available for pick-up at the Department of Finance Payment Processing Counter, City Hall, Room 107. Please allow a minimum of 10 days

for processing.

1

1 2

2