Community Or Marital Property State Beneficiary And Spousal Consent Form - American Fidelity Health Services Administration

ADVERTISEMENT

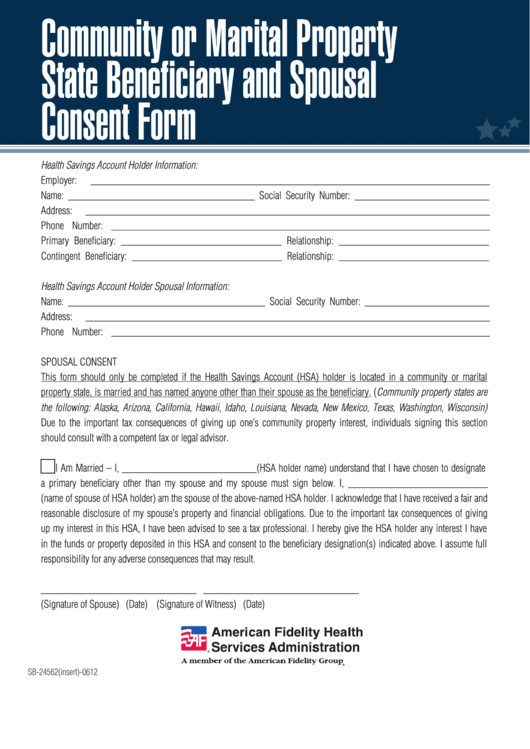

Community or Marital Property

State Beneficiary and Spousal

Consent Form

Health Savings Account Holder Information:

Employer:

_____________________________________________________________________________

Name: ____________________________________ Social Security Number: __________________________

Address:

______________________________________________________________________________

Phone Number: _________________________________________________________________________

Primary Beneficiary: _______________________________ Relationship: _____________________________

Contingent Beneficiary: _____________________________ Relationship: _____________________________

Health Savings Account Holder Spousal Information:

Name: ______________________________________ Social Security Number: ________________________

Address:

______________________________________________________________________________

Phone Number: _________________________________________________________________________

SPOUSAL CONSENT

This form should only be completed if the Health Savings Account (HSA) holder is located in a community or marital

property state, is married and has named anyone other than their spouse as the beneficiary. (Community property states are

the following: Alaska, Arizona, California, Hawaii, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, Wisconsin)

Due to the important tax consequences of giving up one’ s community property interest, individuals signing this section

should consult with a competent tax or legal advisor.

I Am Married – I, __________________________(HSA holder name) understand that I have chosen to designate

a primary beneficiary other than my spouse and my spouse must sign below. I, ___________________________

(name of spouse of HSA holder) am the spouse of the above-named HSA holder. I acknowledge that I have received a fair and

reasonable disclosure of my spouse’s property and financial obligations. Due to the important tax consequences of giving

up my interest in this HSA, I have been advised to see a tax professional. I hereby give the HSA holder any interest I have

in the funds or property deposited in this HSA and consent to the beneficiary designation(s) indicated above. I assume full

responsibility for any adverse consequences that may result.

______________________________

______________________________

(Signature of Spouse)

(Date)

(Signature of Witness)

(Date)

SB-24562(insert)-0612

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1