Form 941me - Employer'S Return Of Maine Income Tax Withholding - 2009

ADVERTISEMENT

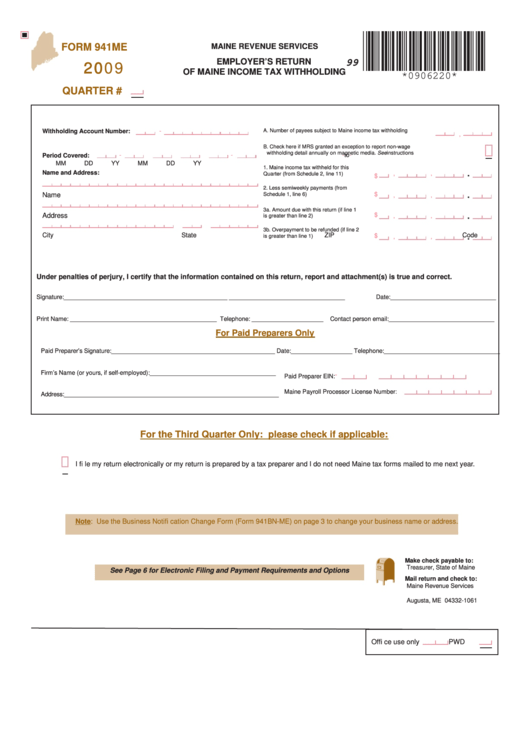

FORM 941ME

MAINE REVENUE SERVICES

2009

EMPLOYER’S RETURN

99

OF MAINE INCOME TAX WITHHOLDING

*0906220*

QUARTER #

-

A.

Number of payees subject to Maine income tax withholding ..........A.

Withholding Account Number:

,

B.

Check here if MRS granted an exception to report non-wage

withholding detail annually on magnetic media. See instructions ..................................... B.

Period Covered:

-

-

to

-

-

MM

DD

YY

MM

DD

YY

1.

Maine income tax withheld for this

Name and Address:

.

,

,

Quarter (from Schedule 2, line 11) .......1.

$

2.

Less semiweekly payments (from

Schedule 1, line 6) ...............................2.

$

.

Name

,

,

3a. Amount due with this return (if line 1

Address

$

.

,

,

is greater than line 2) .........................3a.

3b. Overpayment to be refunded (if line 2

City

State

ZIP Code

$

.

is greater than line 1) .........................3b.

,

,

Under penalties of perjury, I certify that the information contained on this return, report and attachment(s) is true and correct.

Signature:________________________________________________ __________________________________

Date:_______________________________

Print Name: ___________________________________________

Telephone: _____________________

Contact person email:_______________________________

For Paid Preparers Only

Paid Preparer’s Signature:________________________________________________ Date:__________________ Telephone:__________________________________

Firm’s Name (or yours, if self-employed):_____________________________________

-

Paid Preparer EIN:

Maine Payroll Processor License Number:

Address:_______________________________________________________________

For the Third Quarter Only: please check if applicable:

I fi le my return electronically or my return is prepared by a tax preparer and I do not need Maine tax forms mailed to me next year.

Note: Use the Business Notifi cation Change Form (Form 941BN-ME) on page 3 to change your business name or address.

Make check payable to:

Treasurer, State of Maine

See Page 6 for Electronic Filing and Payment Requirements and Options

Mail return and check to:

Maine Revenue Services

P.O. Box 1061

Augusta, ME 04332-1061

Offi ce use only

PWD

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3