Form Wv/mft-504 A - Supplier/permissive Supplier Schedule Of Tax-Paid Receipts - 2004

ADVERTISEMENT

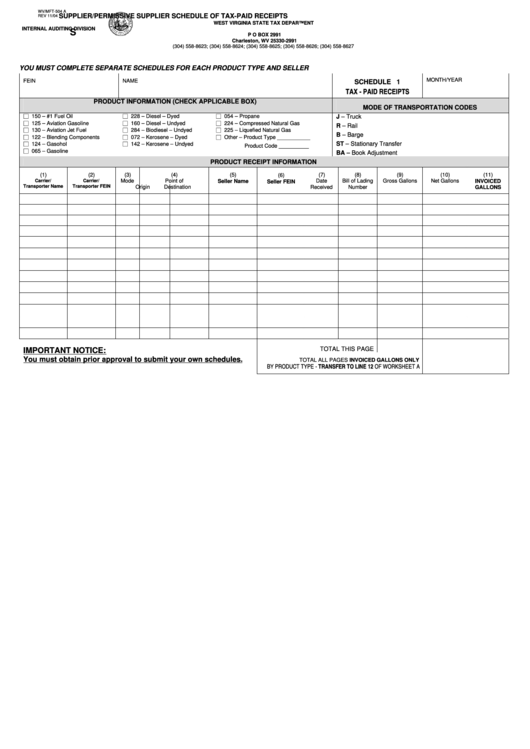

WV/MFT-504 A

SUPPLIER/PERMISSIVE SUPPLIER SCHEDULE OF TAX-PAID RECEIPTS

REV 11/04

WEST VIRGINIA STATE TAX DEPARTMENT

INTERNAL AUDITING DIVISION

S

P O BOX 2991

Charleston, WV 25330-2991

(304) 558-8623; (304) 558-8624; (304) 558-8625; (304) 558-8626; (304) 558-8627

YOU MUST COMPLETE SEPARATE SCHEDULES FOR EACH PRODUCT TYPE AND SELLER

FEIN

NAME

MONTH/YEAR

SCHEDULE 1

TAX - PAID RECEIPTS

PRODUCT INFORMATION (CHECK APPLICABLE BOX)

MODE OF TRANSPORTATION CODES

□ 150 – #1 Fuel Oil

□ 228 – Diesel – Dyed

□ 054 – Propane

J – Truck

□ 125 – Aviation Gasoline

□ 160 – Diesel – Undyed

□ 224 – Compressed Natural Gas

R – Rail

□ 130 – Aviation Jet Fuel

□ 284 – Biodiesel – Undyed

□ 225 – Liquefied Natural Gas

B – Barge

□ 122 – Blending Components

□ 072 – Kerosene – Dyed

□ Other – Product Type ___________

□ 124 – Gasohol

□ 142 – Kerosene – Undyed

ST – Stationary Transfer

Product Code __________

□ 065 – Gasoline

BA – Book Adjustment

PRODUCT RECEIPT INFORMATION

(1)

(2)

(3)

(4)

(5)

(7)

(8)

(9)

(10)

(11)

(6)

Carrier/

Carrier/

Mode

Point of

Date

Bill of Lading

Gross Gallons

Net Gallons

Seller Name

INVOICED

Seller FEIN

Transporter Name

Transporter FEIN

Received

Number

Origin

Destination

GALLONS

TOTAL THIS PAGE

IMPORTANT NOTICE:

You must obtain prior approval to submit your own schedules.

TOTAL ALL PAGES INVOICED GALLONS ONLY

BY PRODUCT TYPE - TRANSFER TO LINE 12 OF WORKSHEET A

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1