Form Pte - New Mexico Income And Information Return For Pass-Through Entities - 2005

ADVERTISEMENT

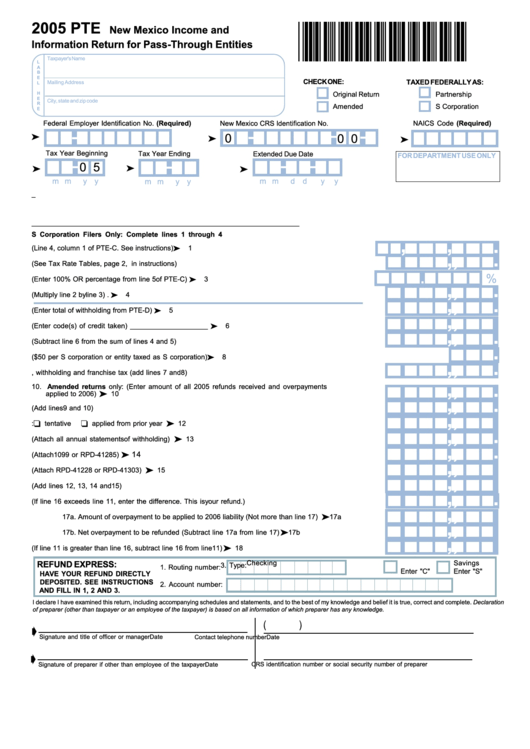

2005 PTE

*57080200*

New Mexico Income and

Information Return for Pass-Through Entities

Taxpayer's Name

L

A

B

E

CHECK ONE:

TAXED FEDERALLY AS:

Mailing Address

L

Original Return

Partnership

H

E

City, state and zip code

R

Amended

S Corporation

E

Federal Employer Identification No. (Required)

New Mexico CRS Identification No.

NAICS Code (Required)

-

-

-

-

0

0 0

Tax Year Beginning

Tax Year Ending

Extended Due Date

FOR DEPARTMENT USE ONLY

-

-

-

-

0 5

m m

y y

m m

d d

y

y

m m

y y

A.

State in which organized _______________________________________ B. Date of organization __________ / __________ / __________

C.

Date business began in New Mexico ________ / ________ / ________

D.

Name and address of registered agent in New Mexico

____________________________________________________________________

S Corporation Filers Only: Complete lines 1 through 4

,

,

.

1.

Income taxable to corporation (Line 4, column 1 of PTE-C. See instructions) .................................

1

,

,

.

2.

Tax on amount on line 1 (See Tax Rate Tables, page 2, in instructions) ................................................ 2

.

%

3.

New Mexico percentage (Enter 100% OR percentage from line 5 of PTE-C) .................................

3

,

,

.

4.

New Mexico income tax (Multiply line 2 by line 3) .............................................................................

4

,

,

.

5.

Withholding tax (Enter total of withholding from PTE-D) ...................................................................

5

,

,

.

6.

Total non-refundable credits from (Enter code(s) of credit taken) ____________________ ........

6

,

,

.

7.

Net income and withholding tax (Subtract line 6 from the sum of lines 4 and 5) ..................................... 7

.

8.

Franchise tax ($50 per S corporation or entity taxed as S corporation) .........................................

8

,

,

.

9.

Total income, withholding and franchise tax (add lines 7 and 8) ............................................................. 9

,

,

.

10. Amended returns only: (Enter amount of all 2005 refunds received and overpayments

applied to 2006) ..................................................................................................................................

10

,

,

.

11. Subtotal (Add lines 9 and 10) .................................................................................................................. 11

,

,

.

12. Total payments:

tentative

applied from prior year ...........................................................

12

,

,

.

13. New Mexico income tax withheld (Attach all annual statements of withholding) ...........................

13

,

,

.

14

14. New Mexico income tax withheld from oil and gas proceeds (Attach 1099 or RPD-41285) ..........

,

,

.

15. Approved film production or filmmaker tax credit claimed (Attach RPD-41228 or RPD-41303) ......

15

,

,

.

16. Total payments and refundable credits (Add lines 12, 13, 14 and 15) .................................................. 16

,

,

.

17. Overpayment (If line 16 exceeds line 11, enter the difference. This is your refund.) ........................... 17

,

,

.

17a. Amount of overpayment to be applied to 2006 liability (Not more than line 17) ...............

17a

,

,

.

17b. Net overpayment to be refunded (Subtract line 17a from line 17) ...................................

17b

,

,

.

18. Tax Due (If line 11 is greater than line 16, subtract line 16 from line 11) .........................................

18

Checking

Savings

REFUND EXPRESS:

3. Type:

1. Routing number:

Enter "C"

Enter "S"

HAVE YOUR REFUND DIRECTLY

DEPOSITED. SEE INSTRUCTIONS

2. Account number:

AND FILL IN 1, 2 AND 3.

I declare I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief it is true, correct and complete. Declaration

of preparer (other than taxpayer or an employee of the taxpayer) is based on all information of which preparer has any knowledge.

(

)

Signature and title of officer or manager

Date

Contact telephone number

Date

CRS identification number or social security number of preparer

Signature of preparer if other than employee of the taxpayer

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1