Guardian Trust Certification Form Page 2

Download a blank fillable Guardian Trust Certification Form in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Guardian Trust Certification Form with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

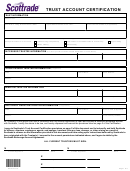

3. Certification

The Trustee(s) declare and represent to the Company that the answers provided in this Trust Certification are accurate and

complete and also certify, acknowledge and agree that:

a)

the Trust is:

Irrevocable and is in full force and in effect;

Revocable and is in full force and in effect;

b)

the Trustee(s) is/are allowed by the terms of the Trust to purchase Life Insurance and Securities (if applicable);

c)

the Trust permits the Trustee(s) to exercise all ownership rights provided by the Policy issued by the Company to the

Trust, including but not limited to, the right to surrender, pledge or encumber the Policy or make withdrawals,

d)

and the Trustee(s) is/are permitted to distribute the Policy to any beneficiary of the Trust or to sell and transfer ownership

of the Policy pursuant to the sale;

e)

neither the Company nor anyone acting as an agent of the Company is responsible to determine the authority of the

Trustee(s) or inquire into, or review the provisions of the Trust, and shall not be charged with knowledge of the terms

of the Trust;

f)

the Company may rely on the evidence submitted with respect to any change of the Trustee(s) and/or the appointment

of a successor Trustee, and is not responsible to determine that the change or the appointment of any additional

or successor Trustee(s) conforms with the Trust provisions;

g)

beneficial interests under the Trust can and will only be established for persons who (1) are related to the Proposed Life

Insured(s) by blood or by law, (2) have a substantial interest in the Proposed Life Insured(s) engendered by love and

affection, or (3) hold a lawful and substantial economic interest in the continued life of the Proposed Life Insured(s); and

h)

neither the Company nor its affiliates, employees, representatives, or agents have provided tax or legal advice and the

Trustee(s) have had the opportunity to consult with their own tax and/or legal advisors regarding the preparation of the

Trust Certification.

4. Tax Certification and Signatures

I agree the following certification applies unless I indicate in the box below that I am not a U.S. Entity.

Under penalties of perjury I certify that:

1.

The number shown on this form is my correct social security number or taxpayer identification number, and

2.

I am not subject to backup withholding because:

a)

I am exempt from backup withholding, or

b)

I have not been notified by the Internal Revenue Service (IRS) that I am subject to backup withholding

as a result of a failure to report all interest or dividends, or

c)

the IRS has notified me that I am no longer subject to backup withholding, and

3.

I am a U.S. citizen (including a U.S. Resident Alien) or domestic business entity, and

4.

I am exempt from FATCA reporting*

Note: Check the box below if you are unable to certify to item #2 and have been notified by the IRS that you are

currently subject to backup withholding because you have failed to report all interest and dividends on your tax return.

I am subject to backup withholding as a result of a failure to report all interest and dividends on my tax return.

* Guardian requires FATCA (Foreign Account Tax Compliance Act) reporting only for certain non-U.S. payees that receive

FATCA withholdable payments. You are not required to provide a FATCA exemption code.

If the Trust is any of the below, please indicate:

A non-grantor trust created or organized under foreign law

A grantor trust that is created or organized under foreign law

A U.S. grantor trust and the grantor is a Non-Resident Alien individual

I have attached a completed IRS Form W-8BEN, W-8BEN-E or other W-8 appropriate for my status. Please obtain a current version of the form

from A foreign person is subject to U.S. tax on U.S. sourced income and a mandatory 30% withholding may apply (for tax treaty

information and eligibility for a reduced rate, please see IRS Publication 515).

X _________________________________________________

Signature of Trustee

Date

By signing below, you jointly and severally indemnify and hold the Company harmless from any liability for acting according to

your instructions under the referenced Trust.

Guardian will rely on this certification and will not be liable for action taken including any tax reporting performed pursuant to and

in reliance on the representations made on this form.

The Internal Revenue Service does not require your consent to any provision of this document other than

the tax certifications made in the W-9 Certification section above.

Signed at _____________________________________

City & State

__________________________________________

_____________________________________________

X

X

Signature of Trustee

Date

Signature of Trustee

Date

TRUST-CERT-2011 (9/14)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2