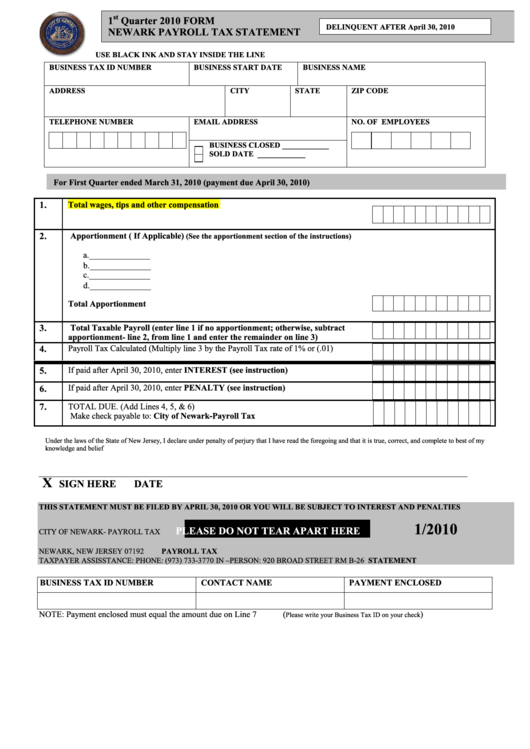

st

1

Quarter 2010 FORM

DELINQUENT AFTER April 30, 2010

NEWARK PAYROLL TAX STATEMENT

USE BLACK INK AND STAY INSIDE THE LINE

BUSINESS TAX ID NUMBER

BUSINESS START DATE

BUSINESS NAME

ADDRESS

CITY

STATE

ZIP CODE

TELEPHONE NUMBER

EMAIL ADDRESS

NO. OF EMPLOYEES

BUSINESS CLOSED ____________

SOLD DATE ____________

For First Quarter ended March 31, 2010 (payment due April 30, 2010)

1.

Total wages, tips and other compensation

2.

Apportionment ( If Applicable)

(See the apportionment section of the instructions)

a.

______________

b.

______________

c.

______________

d.

______________

Total Apportionment

3.

Total Taxable Payroll (enter line 1 if no apportionment; otherwise, subtract

apportionment- line 2, from line 1 and enter the remainder on line 3)

4.

Payroll Tax Calculated (Multiply line 3 by the Payroll Tax rate of 1% or (.01)

5.

If paid after April 30, 2010, enter INTEREST (see instruction)

If paid after April 30, 2010, enter PENALTY (see instruction)

6.

7.

TOTAL DUE. (Add Lines 4, 5, & 6)

Make check payable to: City of Newark-Payroll Tax

Under the laws of the State of New Jersey, I declare under penalty of perjury that I have read the foregoing and that it is true, correct, and complete to best of my

knowledge and belief

X

SIGN HERE

DATE

THIS STATEMENT MUST BE FILED BY APRIL 30, 2010 OR YOU WILL BE SUBJECT TO INTEREST AND PENALTIES

1/2010

PLEASE DO NOT TEAR APART HERE

CITY OF NEWARK- PAYROLL TAX

P.O. BOX 15118

NEWARK, NEW JERSEY 07192

PAYROLL TAX

TAXPAYER ASSISSTANCE: PHONE: (973) 733-3770 IN –PERSON: 920 BROAD STREET RM B-26

STATEMENT

BUSINESS TAX ID NUMBER

CONTACT NAME

PAYMENT ENCLOSED

NOTE: Payment enclosed must equal the amount due on Line 7

(

)

Please write your Business Tax ID on your check

1

1 2

2 3

3 4

4