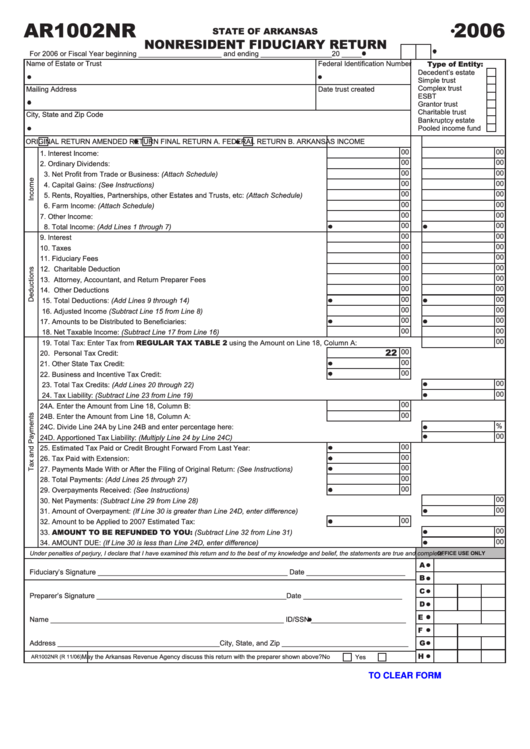

AR1002NR

2006

STATE OF ARKANSAS

NONRESIDENT FIDUCIARY RETURN

For 2006 or Fiscal Year beginning _____________________ and ending __________________ 20 _____

Name of Estate or Trust

Federal Identification Number

Type of Entity:

Decedent’s estate

Simple trust

Complex trust

Mailing Address

Date trust created

ESBT

Grantor trust

Charitable trust

City, State and Zip Code

Bankruptcy estate

Pooled income fund

ORIGINAL RETURN

AMENDED RETURN

FINAL RETURN

A. FEDERAL RETURN

B. ARKANSAS INCOME

00

00

1. Interest Income: ..............................................................................................................1

1

00

00

2. Ordinary Dividends: ........................................................................................................2

2

00

00

3. Net Profit from Trade or Business: (Attach Schedule) ....................................................3

3

00

00

4. Capital Gains: (See Instructions) ....................................................................................4

4

00

00

5. Rents, Royalties, Partnerships, other Estates and Trusts, etc: (Attach Schedule) .........5

5

00

00

6. Farm Income: (Attach Schedule) ....................................................................................6

6

00

00

7. Other Income: .................................................................................................................7

7

00

00

8. Total Income: (Add Lines 1 through 7) ...........................................................................8

8

00

00

9. Interest ...........................................................................................................................9

9

00

00

10. Taxes ............................................................................................................................10

10

00

00

11. Fiduciary Fees .............................................................................................................. 11

11

00

00

12. Charitable Deduction ....................................................................................................12

12

00

00

13. Attorney, Accountant, and Return Preparer Fees .........................................................13

13

00

00

14. Other Deductions .........................................................................................................14

14

00

00

15. Total Deductions: (Add Lines 9 through 14) .................................................................15

15

00

00

16. Adjusted Income (Subtract Line 15 from Line 8) ..........................................................16

16

00

00

17. Amounts to be Distributed to Beneficiaries: .................................................................17

17

00

00

18. Net Taxable Income: (Subtract Line 17 from Line 16) ..................................................18

18

00

19. Total Tax: Enter Tax from REGULAR TAX TABLE 2 using the Amount on Line 18, Column A: ............................. 19

22

00

20. Personal Tax Credit: .....................................................................................................20

00

21. Other State Tax Credit: .................................................................................................21

00

22. Business and Incentive Tax Credit: ..............................................................................22

00

23. Total Tax Credits: (Add Lines 20 through 22) ............................................................................................................... 23

00

24. Tax Liability: (Subtract Line 23 from Line 19) ............................................................................................................... 24

00

24A. Enter the Amount from Line 18, Column B: ................................................................24A

00

24B. Enter the Amount from Line 18, Column A: ............................................................... 24B

%

24C. Divide Line 24A by Line 24B and enter percentage here: ..........................................................................................24C

00

24D. Apportioned Tax Liability: (Multiply Line 24 by Line 24C) ...........................................................................................24D

00

25. Estimated Tax Paid or Credit Brought Forward From Last Year: ..................................25

00

26. Tax Paid with Extension: ..............................................................................................26

00

27. Payments Made With or After the Filing of Original Return: (See Instructions) ............27

00

28. Total Payments: (Add Lines 25 through 27) .................................................................28

00

29. Overpayments Received: (See Instructions) ................................................................29

00

30. Net Payments: (Subtract Line 29 from Line 28) ........................................................................................................... 30

00

31. Amount of Overpayment: (If Line 30 is greater than Line 24D, enter difference) ......................................................... 31

00

32. Amount to be Applied to 2007 Estimated Tax: ..............................................................32

00

33. AMOUNT TO BE REFUNDED TO YOU: (Subtract Line 32 from Line 31) ........................................................... 33

00

34. AMOUNT DUE: (If Line 30 is less than Line 24D, enter difference) ............................................................................. 34

Under penalties of perjury, I declare that I have examined this return and to the best of my knowledge and belief, the statements are true and complete.

OFFICE USE ONLY

A

Fiduciary’s Signature ________________________________________________ Date _________________________

B

C

Preparer’s Signature ________________________________________________ Date _________________________

D

E

Name ___________________________________________________________ ID/SSN ________________________

F

G

Address _________________________________________ City, State, and Zip ________________________________

H

May the Arkansas Revenue Agency discuss this return with the preparer shown above?

Yes

No

AR1002NR (R 11/06)

CLICK HERE TO CLEAR FORM

1

1 2

2