Income Tax Questionnaire Form - State Of Ohio

ADVERTISEMENT

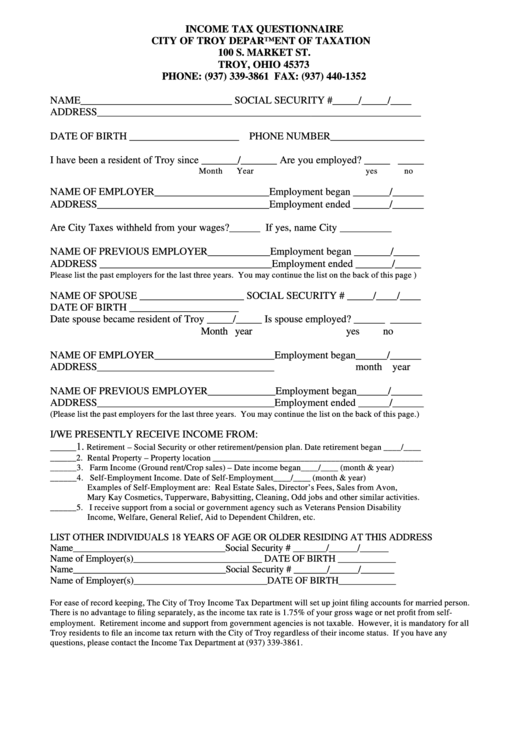

INCOME TAX QUESTIONNAIRE

CITY OF TROY DEPARTMENT OF TAXATION

100 S. MARKET ST.

TROY, OHIO 45373

PHONE: (937) 339-3861 FAX: (937) 440-1352

NAME_____________________________ SOCIAL SECURITY #_____/_____/____

ADDRESS______________________________________________________________

DATE OF BIRTH _____________________ PHONE NUMBER__________________

I have been a resident of Troy since _______/_______ Are you employed? _____ _____

Month

Year

yes

no

NAME OF EMPLOYER______________________Employment began _______/______

ADDRESS_________________________________Employment ended _______/______

Are City Taxes withheld from your wages?______ If yes, name City __________

NAME OF PREVIOUS EMPLOYER____________Employment began _______/_____

ADDRESS _________________________________Employment ended _______/_____

Please list the past employers for the last three years. You may continue the list on the back of this page )

NAME OF SPOUSE ____________________ SOCIAL SECURITY # _____/____/____

DATE OF BIRTH _____________________

Date spouse became resident of Troy _____/_____ Is spouse employed? ______ ______

Month year

yes

no

NAME OF EMPLOYER_______________________Employment began______/______

ADDRESS__________________________________

month year

NAME OF PREVIOUS EMPLOYER_____________Employment began______/______

ADDRESS__________________________________Employment ended ______/______

(Please list the past employers for the last three years. You may continue the list on the back of this page.)

I/WE PRESENTLY RECEIVE INCOME FROM:

_____1.

Retirement – Social Security or other retirement/pension plan. Date retirement began ____/____

______2. Rental Property – Property location ________________________________________________

______3. Farm Income (Ground rent/Crop sales) – Date income began____/____ (month & year)

______4. Self-Employment Income. Date of Self-Employment____/____ (month & year)

Examples of Self-Employment are: Real Estate Sales, Director’s Fees, Sales from Avon,

Mary Kay Cosmetics, Tupperware, Babysitting, Cleaning, Odd jobs and other similar activities.

______5. I receive support from a social or government agency such as Veterans Pension Disability

Income, Welfare, General Relief, Aid to Dependent Children, etc.

LIST OTHER INDIVIDUALS 18 YEARS OF AGE OR OLDER RESIDING AT THIS ADDRESS

Name________________________________Social Security # _______/______/______

Name of Employer(s)___________________________ DATE OF BIRTH ____________

Name________________________________Social Security # _______/______/_______

Name of Employer(s)____________________________DATE OF BIRTH____________

For ease of record keeping, The City of Troy Income Tax Department will set up joint filing accounts for married person.

There is no advantage to filing separately, as the income tax rate is 1.75% of your gross wage or net profit from self-

employment. Retirement income and support from government agencies is not taxable. However, it is mandatory for all

Troy residents to file an income tax return with the City of Troy regardless of their income status. If you have any

questions, please contact the Income Tax Department at (937) 339-3861.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1