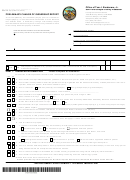

PRELIMINARY CHANGE OF OWNERSHIP REPORT

Please answer, to the best of your knowledge, all applicable questions, sign and date. If a question does not apply, indicate with “N/A”.

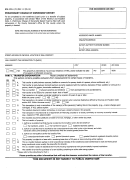

PART III: PURCHASE PRICE AND TERMS OF SALE

A. CASH DOWN PAYMENT OR Value of Trade or Exchange (excluding closing costs)

Amount $ ____________________

B. FIRST DEED OF TRUST @ ______ % interest for ______ years. Payments per Month= $ _____________ (Principal & Interest only)

Amount $ ____________________

FHA (_____ Discount Points)

Fixed Rate

New Loan

Conventional

Variable Rate

Assumed Existing Loan Balance

VA (_____ Discount Points)

All Inclusive D.T. ($____________ Wrapped)

Bank or Savings & Loan

Cal-Vet

Loan Carried by Seller

Finance Company

Balloon Payment

Yes

No

Due Date _______________________

Amount $ ____________________

C. SECOND DEED OF TRUST @ ______ % interest for ______ years. Payments per Month= $ _____________ (Principal & Interest only)

Amount $ ____________________

Bank or Savings and Loan

Fixed Rate

New Loan

Loan Carried by Seller

Variable Rate

Assumed Existing Loan Balance

Balloon Payment

Yes

No

Due Date _______________________

Amount $ ____________________

D.

OTHER FINANCING: Is other financing involved not covered in (b) or (c) above?

Yes

No

Type _____________________ @ ______ % interest for ______ years. Payments per Month= $ _____________ (Principal & Interest only) Amount $ ____________________

Bank or Savings and Loan

Fixed Rate

New Loan

Loan Carried by Seller

Variable Rate

Assumed Existing Loan Balance

Balloon Payment

Yes

No

Due Date _______________________

Amount $ ____________________

E. WAS AN IMPROVEMENT BOND ASSUMED BY THE BUYER?

Yes

No

Outstanding Balance:

Amount $ ____________________

F. TOTAL PURCHASE PRICE (or acquisition price, if traded or exchanged, include real estate commission if paid.)

$

0.00

Total Items A through E

G. PROPERTY PURCHASED

Through a broker

Direct from Seller

From a family member

Other (explain) _________________________________________

If purchased through a broker, provide broker’s name and phone number:

Please explain any special terms, seller concessions or financing and any other information that would help the Assessor understand the purchase price and terms of sale.

PART IV: PROPERTY INFORMATION

A. TYPE OF PROPERTY TRANSFERRED:

Single Family Residence

Agricultural

Timeshare

Multiple Family Residence (no. of units __________)

Co-op/Own-your-own

Manufactured Home

Commercial/Industrial

Condominium

Unimproved Lot

Other (Description: _____________________________________________________________________________ )

B. IS THIS PROPERTY INTENDED AS YOUR PRINCIPAL RESIDENCE?

Yes

No

If yes, enter date of occupancy _______________________________

or intended occupancy _____________________________________

Month

Day

Year

Month

Day

Year

C. IS THIS PERSONAL PROPERTY INCLUDED IN PURCHASE PRICE (i.e. furniture, farm equipment, machinery, etc.)

(other than a manufactured home subject to local property tax)?

Yes

No

If yes, enter the value of the personal property included in the purchase price $ ________________________ (Attach itemized list of personal property)

D. IS A MANUFACTURED HOME INCLUDED IN PURCHASE PRICE?

Yes

No

If yes, how much of the purchase price is allocated to the manufactured home? $___________________________

Is the manufactured home subject to local property tax?

Yes

No

What is the Decal Number? ______________________________

E. DOES THE PROPERTY PRODUCE INCOME?

Yes

No

If yes the income is from:

Lease/Rent

Contract

Mineral Rights

Other – Explain ______________________________________________________

F. WHAT WAS THE CONDITION OF PROPERTY AT THE TIME OF SALE?

Good

Average

Fair

Poor

Please explain the physical condition of the property and provide any other information (such as restrictions, etc.) that would assist the Assessor in

determining the value of the property.

I certify that the foregoing is true, correct and complete to the best of my knowledge and belief.

Signed _____________________________________________________________________________________________ Date ________________________

NEW OWNER / CORPORATE OFFICER

Please print Name of New Owner / Corporate Officer _____________________________________________________________________________________

Phone Number where you are available from 8:00 a.m. – 5:00 p.m. _________________________________

(NOTE: The Assessor may contact you for further information)

If a document evidencing a change of ownership is presented to the recorder for recordation without the concurrent filing of a preliminary change of ownership

report the recorder may charge an additional recording fee of twenty dollars ($20.00).

Page 2 of 2

1

1 2

2