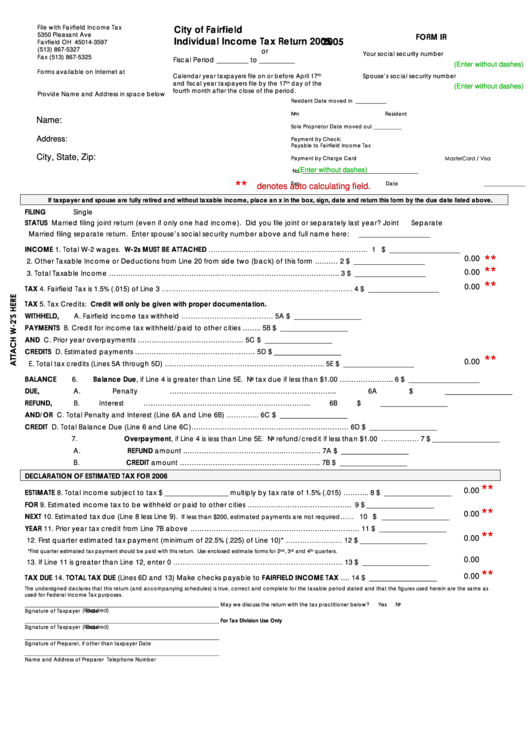

File with Fairfield Income Tax

City of Fairfield

5350 Pleasant Ave

FORM IR

2005

Individual Income Tax Return 2005

Fairfield OH 45014-3597

(513) 867-5327

or

Your social security number

Fax (513) 867-5325

Fiscal Period _________ to __________

(Enter without dashes)

Forms available on Internet at

Calendar year taxpayers file on or before April 17

Spouse’s social security number

th

and fiscal year taxpayers file by the 17

day of the

th

(Enter without dashes)

fourth month after the close of the period.

Provide Name and Address in space below

Resident

Date moved in ____________

Non Resident

Name:

Sole Proprietor

Date moved out ___________

Address:

Payment by Check:

Payable to Fairfield Income Tax

City, State, Zip:

Payment by Charge Card

MasterCard / Visa

(Enter without dashes)

No. _____________________________________________

Exp Date ________________

**

denotes auto calculating field.

If taxpayer and spouse are fully retired and without taxable income, place an x in the box, sign, date and return this form by the due date listed above.

FILING

Single

STATUS

Married filing joint return (even if only one had income). Did you file joint or separately last year?

Joint

Separate

Married filing separate return. Enter spouse’s social security number above and full name here:

____________________

INCOME

1.

Total W-2 wages. W-2s MUST BE ATTACHED ………………………………….……….……………… 1

$ ____________________

0.00

**

2.

Other Taxable Income or Deductions from Line 20 from side two (back) of this form ….…… 2

$ ____________________

**

3.

Total Taxable Income …………………………………………………………………………………….. 3

$ ____________________

0.00

**

TAX

4.

Fairfield Tax is 1.5% (.015) of Line 3 ……………………………………………………………………… 4

$ ____________________

0.00

TAX

5.

Tax Credits: Credit will only be given with proper documentation.

WITHHELD,

A.

Fairfield income tax withheld ………………………………… 5A $ ___________________

PAYMENTS

B.

Credit for income tax withheld/paid to other cities ……..

5B

$ ___________________

AND

C.

Prior year overpayments ………………………………………

5C $ ___________________

CREDITS

D.

Estimated payments …………………………………………… 5D $ ___________________

**

0.00

E.

Total tax credits (Lines 5A through 5D) ………………………………………………………….. 5E

$ ____________________

BALANCE

6.

Balance Due, if Line 4 is greater than Line 5E. No tax due if less than $1.00 ………………….. 6

$ ____________________

DUE,

A.

Penalty …………………………………………………………….. 6A $ ___________________

REFUND,

B.

Interest …………………………………………………………….. 6B

$ ___________________

AND/OR

C.

Total Penalty and Interest (Line 6A and Line 6B) ………….. 6C $ ___________________

CREDIT

D.

Total Balance Due (Line 6 and Line 6C)………………………………………….……………… 6D $ ___________________

7.

Overpayment, if Line 4 is less than Line 5E. No refund/credit if less than $1.00 ....……………. 7

$ ___________________

A.

REFUND amount ..…………………………………..……………. 7A $ ___________________

B.

CREDIT amount …………………………………………………... 7B

$ ___________________

DECLARATION OF ESTIMATED TAX FOR 2006

**

0.00

ESTIMATE

8.

Total income subject to tax $ __________________ multiply by tax rate of 1.5% (.015) ……….. 8

$ ___________________

FOR

9.

Estimated income tax to be withheld or paid to other cities ……………………..……..……….. 9

$ ___________________

**

0.00

NEXT

10. Estimated tax due (Line 8 less Line 9).

…… 10

$ ___________________

If less than $200, estimated payments are not required

YEAR

11. Prior year tax credit from Line 7B above ……………………………………………………………… 11

$ ___________________

**

0.00

12. First quarter estimated tax payment (minimum of 22.5% (.225) of Line 10)* …………………… 12

$ ___________________

*First quarter estimated tax payment should be paid with this return. Use enclosed estimate forms for 2

, 3

and 4

quarters.

nd

rd

th

0.00

13. If Line 11 is greater than Line 12, enter 0 ……………………………………………………………… 13

$ ___________________

**

TAX DUE

14. TOTAL TAX DUE (Lines 6D and 13) Make checks payable to FAIRFIELD INCOME TAX ….

14

$ ___________________

0.00

The undersigned declares that this return (and accompanying schedules) is true, correct and complete for the taxable period stated and that the figures used herein are the same as

used for Federal Income Tax purposes.

____________________________________________________________________________

May we discuss the return with the tax practitioner below?

Yes

No

(Required)

Signature of Taxpayer

Date

____________________________________________________________________________

For Tax Division Use Only

(Required)

Signature of Taxpayer

Date

____________________________________________________________________________

Signature of Preparer, if other than taxpayer

Date

____________________________________________________________________________

Name and Address of Preparer

Telephone Number

1

1 2

2