City Of Akron Income Tax

ADVERTISEMENT

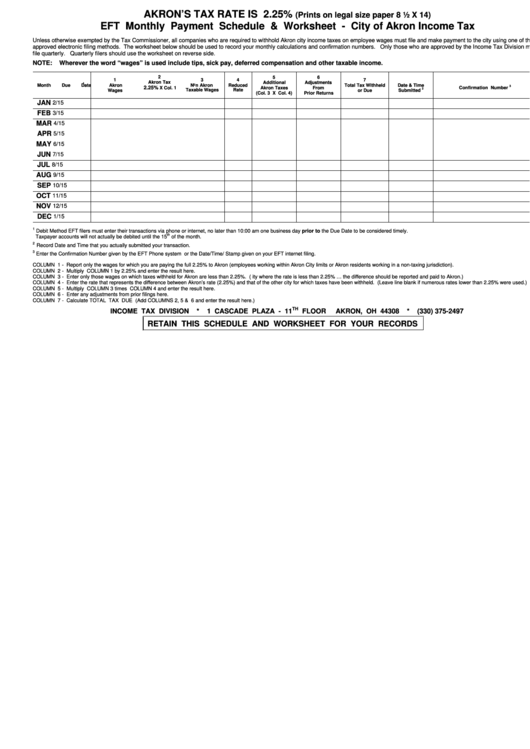

AKRON’S TAX RATE IS 2.25%

(Prints on legal size paper 8 ½ X 14)

EFT Monthly Payment Schedule & Worksheet - City of Akron Income Tax

Unless otherwise exempted by the Tax Commissioner, all companies who are required to withhold Akron city income taxes on employee wages must file and make payment to the city using one of three

approved electronic filing methods. The worksheet below should be used to record your monthly calculations and confirmation numbers. Only those who are approved by the Income Tax Division may

file quarterly. Quarterly filers should use the worksheet on reverse side.

NOTE:

Wherever the word “wages” is used include tips, sick pay, deferred compensation and other taxable income.

2

5

6

1

3

4

7

Akron Tax

Additional

Adjustments

1

Month

Due Date

Akron

Non Akron

Reduced

Total Tax Withheld

Date & Time

3

2.25%

X Col. 1

Akron Taxes

From

Confirmation Number

2

Wages

Taxable Wages

Rate

or Due

Submitted

(Col. 3 X Col. 4)

Prior Returns

JAN

2/15

FEB

3/15

MAR

4/15

APR

5/15

MAY

6/15

JUN

7/15

JUL

8/15

AUG

9/15

SEP

10/15

OCT

11/15

NOV

12/15

DEC

1/15

1

Debit Method EFT filers must enter their transactions via phone or internet, no later than 10:00 am one business day prior to the Due Date to be considered timely.

th

Taxpayer accounts will not actually be debited until the 15

of the month.

2

Record Date and Time that you actually submitted your transaction.

3

Enter the Confirmation Number given by the EFT Phone system or the Date/Time/ Stamp given on your EFT internet filing.

COLUMN 1 - Report only the wages for which you are paying the full 2.25% to Akron (employees working within Akron City limits or Akron residents working in a non-taxing jurisdiction).

COLUMN 2 - Multiply COLUMN 1 by 2.25% and enter the result here.

COLUMN 3 - Enter only those wages on which taxes withheld for Akron are less than 2.25%. (e.g. Akron resident working in a city where the rate is less than 2.25% … the difference should be reported and paid to Akron.)

COLUMN 4 - Enter the rate that represents the difference between Akron’s rate (2.25%) and that of the other city for which taxes have been withheld. (Leave line blank if numerous rates lower than 2.25% were used.)

COLUMN 5 - Multiply COLUMN 3 times COLUMN 4 and enter the result here.

COLUMN 6 - Enter any adjustments from prior filings here.

COLUMN 7 - Calculate TOTAL TAX DUE (Add COLUMNS 2, 5 & 6 and enter the result here.)

TH

INCOME TAX DIVISION

*

1 CASCADE PLAZA - 11

FLOOR

AKRON, OH 44308

*

(330) 375-2497

RETAIN THIS SCHEDULE AND WORKSHEET FOR YOUR RECORDS

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1