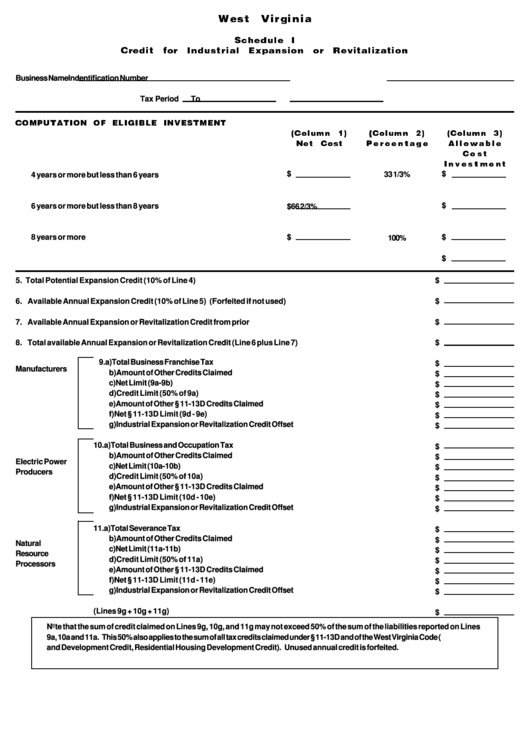

W e s t

V i r g i n i a

S c h e d u l e

I

C r e d i t

f o r

I n d u s t r i a l

E x p a n s i o n

o r

R e v i t a l i z a t i o n

Business Name

Indentification Number

Tax Period

To

C O M P U T A T I O N

O F

E L I G I B L E

I N V E S T M E N T

( C o l u m n

1 )

( C o l u m n

2 )

( C o l u m n

3 )

N e t

C o s t

P e r c e n t a g e

A l l o w a b l e

C o s t

1.

Expansion or Revitalization property with useful life of

I n v e s t m e n t

$

$

4 years or more but less than 6 years

33 1/3%

2.

Expansion or Revitalization property with useful life of

$

6 years or more but less than 8 years

$

66 2/3%

3.

Expansion or Revitalization property with useful life of

8 years or more

$

$

100%

4.

Total Eligible Expansion or Revitalization Investment

$

5. Total Potential Expansion Credit (10% of Line 4) .........................................................................................................

$

6. Available Annual Expansion Credit (10% of Line 5) (Forfeited if not used) .................................................................

$

7. Available Annual Expansion or Revitalization Credit from prior years ........................................................................

$

8. Total available Annual Expansion or Revitalization Credit (Line 6 plus Line 7) ............................................................

$

9. a)

Total Business Franchise Tax ............................................................................................

$

Manufacturers

b)

Amount of Other Credits Claimed .....................................................................................

$

c)

Net Limit (9a-9b) ................................................................................................................

$

d)

Credit Limit (50% of 9a) .....................................................................................................

$

e)

Amount of Other § 11-13D Credits Claimed.......................................................................

$

f)

Net § 11-13D Limit (9d - 9e) ................................................................................................

$

g)

Industrial Expansion or Revitalization Credit Offset .........................................................

$

10. a)

Total Business and Occupation Tax ..................................................................................

$

b)

Amount of Other Credits Claimed .....................................................................................

$

Electric Power

c)

Net Limit (10a-10b) .............................................................................................................

$

Producers

d)

Credit Limit (50% of 10a) ...................................................................................................

$

e)

Amount of Other § 11-13D Credits Claimed.......................................................................

$

f)

Net § 11-13D Limit (10d - 10e) ............................................................................................

$

g)

Industrial Expansion or Revitalization Credit Offset .........................................................

$

11. a)

Total Severance Tax ..........................................................................................................

$

b)

Amount of Other Credits Claimed .....................................................................................

$

Natural

c)

Net Limit (11a-11b) .............................................................................................................

$

Resource

d)

Credit Limit (50% of 11a) ...................................................................................................

$

Processors

e)

Amount of Other § 11-13D Credits Claimed.......................................................................

$

f)

Net § 11-13D Limit (11d - 11e) ............................................................................................

$

g)

Industrial Expansion or Revitalization Credit Offset .........................................................

$

12. Total credit claimed (Lines 9g + 10g + 11g) ..............................................................................

$

Note that the sum of credit claimed on Lines 9g, 10g, and 11g may not exceed 50% of the sum of the liabilities reported on Lines

9a, 10a and 11a. This 50% also applies to the sum of all tax credits claimed under § 11-13D and of the West Virginia Code (i.e. Research

and Development Credit, Residential Housing Development Credit). Unused annual credit is forfeited.

1

1 2

2