Instructions For Form 8582-Cr - Passive Activity Credit Limitations - 2012

ADVERTISEMENT

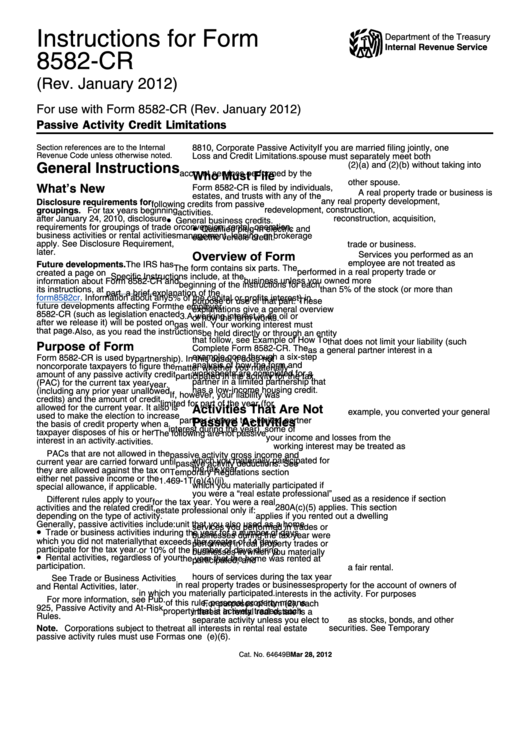

Instructions for Form

Department of the Treasury

Internal Revenue Service

8582-CR

(Rev. January 2012)

For use with Form 8582-CR (Rev. January 2012)

Passive Activity Credit Limitations

Section references are to the Internal

8810, Corporate Passive Activity

If you are married filing jointly, one

Revenue Code unless otherwise noted.

Loss and Credit Limitations.

spouse must separately meet both

General Instructions

(2)(a) and (2)(b) without taking into

Who Must File

account services performed by the

other spouse.

What’s New

Form 8582-CR is filed by individuals,

A real property trade or business is

estates, and trusts with any of the

any real property development,

Disclosure requirements for

following credits from passive

redevelopment, construction,

groupings. For tax years beginning

activities.

after January 24, 2010, disclosure

•

reconstruction, acquisition,

General business credits.

•

requirements for groupings of trade or

conversion, rental, operation,

Qualified plug-in electric and

business activities or rental activities

management, leasing, or brokerage

electric vehicle credit.

apply. See Disclosure Requirement,

trade or business.

later.

Overview of Form

Services you performed as an

employee are not treated as

Future developments. The IRS has

The form contains six parts. The

performed in a real property trade or

created a page on IRS.gov for

Specific Instructions include, at the

business unless you owned more

information about Form 8582-CR and

beginning of the instructions for each

its instructions, at

than 5% of the stock (or more than

part, a brief explanation of the

form8582cr. Information about any

5% of the capital or profits interest) in

purpose or use of that part. These

future developments affecting Form

the employer.

explanations give a general overview

8582-CR (such as legislation enacted

3. A working interest in an oil or

of how the form works.

after we release it) will be posted on

gas well. Your working interest must

that page.

Also, as you read the instructions

be held directly or through an entity

that follow, see Example of How To

that does not limit your liability (such

Purpose of Form

Complete Form 8582-CR. The

as a general partner interest in a

example goes through a six-step

Form 8582-CR is used by

partnership). In this case, it does not

analysis of how the form and

noncorporate taxpayers to figure the

matter whether you materially

worksheets are completed for a

amount of any passive activity credit

participated in the activity for the tax

partner in a limited partnership that

(PAC) for the current tax year

year.

has a low-income housing credit.

(including any prior year unallowed

If, however, your liability was

credits) and the amount of credit

limited for part of the year (for

Activities That Are Not

allowed for the current year. It also is

example, you converted your general

used to make the election to increase

Passive Activities

partner interest to a limited partner

the basis of credit property when a

interest during the year), some of

taxpayer disposes of his or her

The following are not passive

your income and losses from the

interest in an activity.

activities.

working interest may be treated as

1. Trade or business activities in

PACs that are not allowed in the

passive activity gross income and

which you materially participated for

current year are carried forward until

passive activity deductions. See

the tax year.

they are allowed against the tax on

Temporary Regulations section

2. Any rental real estate activity in

either net passive income or the

1.469-1T(e)(4)(ii).

which you materially participated if

special allowance, if applicable.

4. The rental of a dwelling unit you

you were a “real estate professional”

used as a residence if section

Different rules apply to your

for the tax year. You were a real

280A(c)(5) applies. This section

activities and the related credit,

estate professional only if:

applies if you rented out a dwelling

depending on the type of activity.

a. More than half of the personal

Generally, passive activities include:

unit that you also used as a home

services you performed in trades or

•

Trade or business activities in

during the year for a number of days

businesses during the tax year were

which you did not materially

that exceeds the greater of 14 days

performed in real property trades or

participate for the tax year.

or 10% of the number of days during

businesses in which you materially

•

Rental activities, regardless of your

the year that the home was rented at

participated, and

participation.

a fair rental.

b. You performed more than 750

hours of services during the tax year

5. An activity of trading personal

See Trade or Business Activities

in real property trades or businesses

property for the account of owners of

and Rental Activities, later.

in which you materially participated.

interests in the activity. For purposes

For more information, see Pub.

of this rule, personal property means

For purposes of item (2), each

925, Passive Activity and At-Risk

property that is actively traded, such

interest in rental real estate is a

Rules.

as stocks, bonds, and other

separate activity unless you elect to

Note. Corporations subject to the

treat all interests in rental real estate

securities. See Temporary

passive activity rules must use Form

as one activity.

Regulations section 1.469-1T(e)(6).

Mar 28, 2012

Cat. No. 64649B

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16