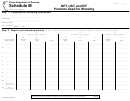

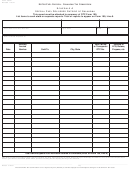

Form Rmft-29 - Schedule M - Special Fuels - Instructions

ADVERTISEMENT

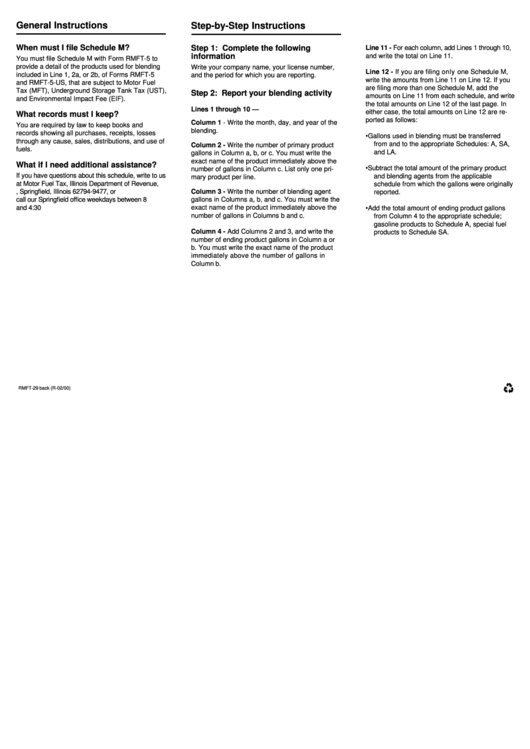

General Instructions

Step-by-Step Instructions

When must I file Schedule M?

Step 1: Complete the following

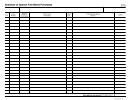

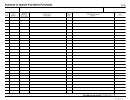

Line 11 - For each column, add Lines 1 through 10,

information

and write the total on Line 11.

You must file Schedule M with Form RMFT-5 to

provide a detail of the products used for blending

Write your company name, your license number,

Line 12 - If you are filing only one Schedule M,

included in Line 1, 2a, or 2b, of Forms RMFT-5

and the period for which you are reporting.

write the amounts from Line 11 on Line 12. If you

and RMFT-5-US, that are subject to Motor Fuel

are filing more than one Schedule M, add the

Tax (MFT), Underground Storage Tank Tax (UST),

Step 2: Report your blending activity

amounts on Line 11 from each schedule, and write

and Environmental Impact Fee (EIF).

the total amounts on Line 12 of the last page. In

Lines 1 through 10 —

either case, the total amounts on Line 12 are re-

What records must I keep?

ported as follows:

Column 1 - Write the month, day, and year of the

You are required by law to keep books and

blending.

records showing all purchases, receipts, losses

• Gallons used in blending must be transferred

through any cause, sales, distributions, and use of

from and to the appropriate Schedules: A, SA,

Column 2 - Write the number of primary product

fuels.

and LA.

gallons in Column a, b, or c. You must write the

exact name of the product immediately above the

What if I need additional assistance?

• Subtract the total amount of the primary product

number of gallons in Column c. List only one pri-

If you have questions about this schedule, write to us

and blending agents from the applicable

mary product per line.

at Motor Fuel Tax, Illinois Department of Revenue,

schedule from which the gallons were originally

P .O. Box 19477, Springfield, Illinois 62794-9477, or

Column 3 - Write the number of blending agent

reported.

call our Springfield office weekdays between 8 a.m.

gallons in Columns a, b, and c. You must write the

and 4:30 p.m. at 217 782-2291.

exact name of the product immediately above the

• Add the total amount of ending product gallons

number of gallons in Columns b and c.

from Column 4 to the appropriate schedule;

gasoline products to Schedule A, special fuel

Column 4 - Add Columns 2 and 3, and write the

products to Schedule SA.

number of ending product gallons in Column a or

b. You must write the exact name of the product

immediately above the number of gallons in

Column b.

RMFT-29 back (R-02/00)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1