Offer In Compromise Form - Louisiana Department Of Revenue - 2004 Page 3

ADVERTISEMENT

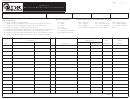

R-20211 (8/04)

Louisiana Department of Revenue

Basic Information Concerning

Offer in Compromise

Before submitting an Offer in Compromise , please consider the following:

An approved Offer in Compromise usually results in a lump-sum payment to the Louisiana Department of

Revenue. However, in extraordinary circumstances, the Department may consider offers that provide

payments to be made over a period of time based on future income. Funds previously collected by the

Department will not be considered part of an Offer in Compromise .

An approved Offer in Compromise is not protected by the confidentiality provisions of Louisiana Revised

Statutes 47:1508 and 1508.1. An Offer in Compromise , signed by all parties and including the reason, is a

public record and is open to public inspection upon request. A list of approved Offers in Compromise

is required to be published in the Department’s annual report.

Compromise Procedures

I.

Compromise of Tax Liabilities

The Secretary of Revenue, with the written approval of two assistant secretaries and the Louisiana Board of

Tax Appeals, under R.S. 47:295 and 1578(4), may compromise any judgments for taxes of $500,000 or less,

exclusive of interest and penalty, including assessments for such amounts that are equivalent to

judgments upon a determination that any of the following apply:

a. There is serious doubt as to the collectibility of the outstanding judgment.

b. There is serious doubt as to the taxpayer’s liability for the outstanding judgment.

c. The administration and collection costs involved would exceed the amount of the outstanding liability.

II. Offer in Compromise

a. An Offer in Compromise must be submitted in writing to the Department of Revenue. A financial

statement made under oath must be submitted with any request for an Offer in Compromise that is

based on serious doubt as to the collectibility of an outstanding judgment. Forms shall be provided by

the Department of Revenue. A conference may be scheduled with the appropriate director for the

purpose of discussing a possible offer.

b. A nonrefundable payment of 10 percent of the offered amount may be required to accompany an Offer

in Compromise . In the event the Offer in Compromise is rejected, the deposit shall be applied to the

taxpayer’s outstanding tax liability.

c. Collection efforts shall not be automatically suspended upon the making of an Offer in Compromise .

However, the Department may suspend its collection efforts if the interest of the State will not be affected.

d. No Offer in Compromise shall be considered while a criminal investigation or prosecution is pending.

e. Interest and penalty will continue to accrue on the unpaid tax liability.

f.

State tax liens will not be released until the offer is accepted and the amount offered is paid in full.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8