Form 870 - Instructions

ADVERTISEMENT

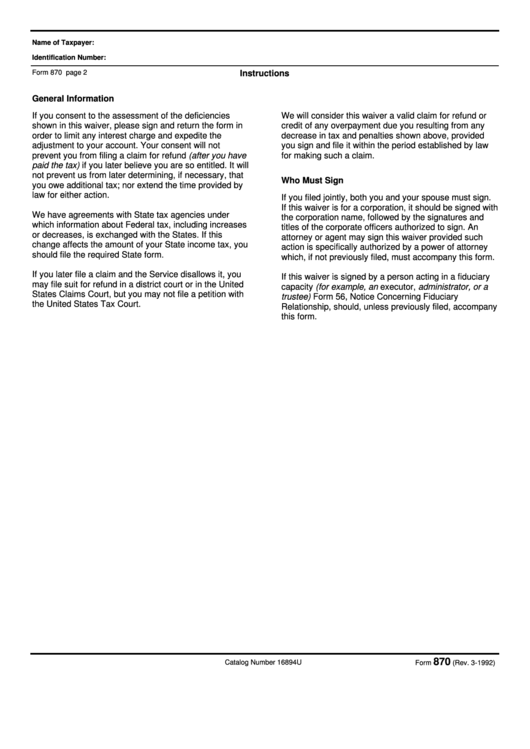

Name of Taxpayer:

Identification Number:

Form 870 page 2

Instructions

General Information

If you consent to the assessment of the deficiencies

We will consider this waiver a valid claim for refund or

shown in this waiver, please sign and return the form in

credit of any overpayment due you resulting from any

order to limit any interest charge and expedite the

decrease in tax and penalties shown above, provided

adjustment to your account. Your consent will not

you sign and file it within the period established by law

prevent you from filing a claim for refund (after you have

for making such a claim.

paid the tax) if you later believe you are so entitled. It will

not prevent us from later determining, if necessary, that

Who Must Sign

you owe additional tax; nor extend the time provided by

law for either action.

If you filed jointly, both you and your spouse must sign.

If this waiver is for a corporation, it should be signed with

We have agreements with State tax agencies under

the corporation name, followed by the signatures and

which information about Federal tax, including increases

titles of the corporate officers authorized to sign. An

or decreases, is exchanged with the States. If this

attorney or agent may sign this waiver provided such

change affects the amount of your State income tax, you

action is specifically authorized by a power of attorney

should file the required State form.

which, if not previously filed, must accompany this form.

If you later file a claim and the Service disallows it, you

If this waiver is signed by a person acting in a fiduciary

may file suit for refund in a district court or in the United

capacity (for example, an executor, administrator, or a

States Claims Court, but you may not file a petition with

trustee) Form 56, Notice Concerning Fiduciary

the United States Tax Court.

Relationship, should, unless previously filed, accompany

this form.

870

Catalog Number 16894U

Form

(Rev. 3-1992)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1