Schedule S To Form Rl-1120 - Tax Computation - State Of Rhode Island Department Of Administration Division Of Taxation

ADVERTISEMENT

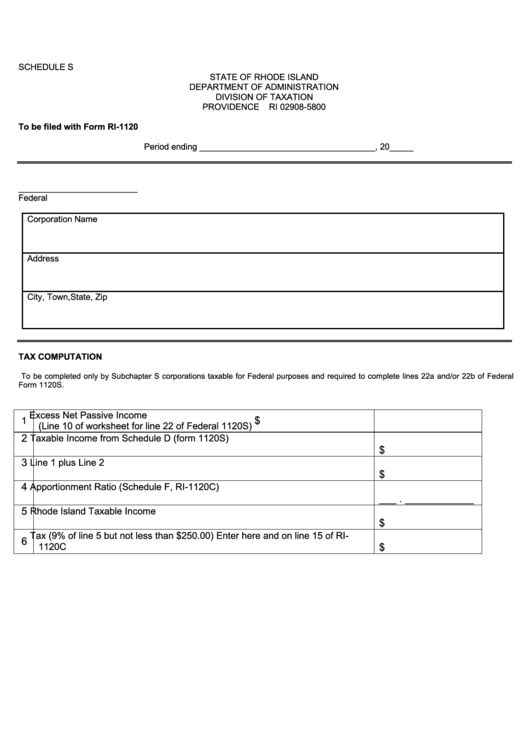

SCHEDULE S

STATE OF RHODE ISLAND

DEPARTMENT OF ADMINISTRATION

DIVISION OF TAXATION

PROVIDENCE

RI 02908-5800

To be filed with Form RI-1120

Period ending _____________________________________, 20_____

_________________________

Federal I.D. No.

Corporation Name

Address

City, Town,State, Zip

TAX COMPUTATION

To be completed only by Subchapter S corporations taxable for Federal purposes and required to complete lines 22a and/or 22b of Federal

Form 1120S.

Excess Net Passive Income

$

1

(Line 10 of worksheet for line 22 of Federal 1120S)

2

Taxable Income from Schedule D (form 1120S)

$

3

Line 1 plus Line 2

$

4

Apportionment Ratio (Schedule F, RI-1120C)

___ . ____________

5

Rhode Island Taxable Income

$

Tax (9% of line 5 but not less than $250.00) Enter here and on line 15 of RI-

6

1120C

$

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1