Instructions For Maine Special Fuel Supplier/retailer Tax Return Form Sfs-1 - Maine

ADVERTISEMENT

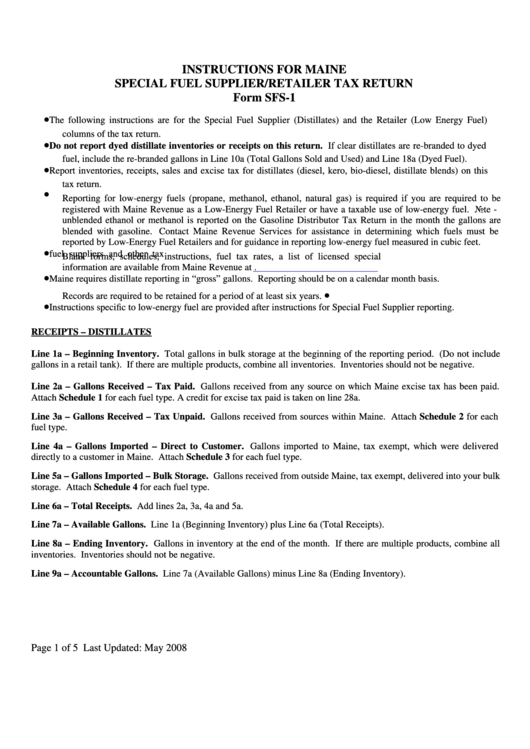

INSTRUCTIONS FOR MAINE

SPECIAL FUEL SUPPLIER/RETAILER TAX RETURN

Form SFS-1

•

The following instructions are for the Special Fuel Supplier (Distillates) and the Retailer (Low Energy Fuel)

columns of the tax return.

•

Do not report dyed distillate inventories or receipts on this return. If clear distillates are re-branded to dyed

fuel, include the re-branded gallons in Line 10a (Total Gallons Sold and Used) and Line 18a (Dyed Fuel).

•

Report inventories, receipts, sales and excise tax for distillates (diesel, kero, bio-diesel, distillate blends) on this

tax return.

•

Reporting for low-energy fuels (propane, methanol, ethanol, natural gas) is required if you are required to be

registered with Maine Revenue as a Low-Energy Fuel Retailer or have a taxable use of low-energy fuel. Note -

unblended ethanol or methanol is reported on the Gasoline Distributor Tax Return in the month the gallons are

blended with gasoline. Contact Maine Revenue Services for assistance in determining which fuels must

be

reported by Low-Energy Fuel Retailers and for guidance in reporting low-energy fuel measured in cubic feet.

•

Blank forms, schedules, instructions, fuel tax rates, a list of licensed special

fuel suppliers and other tax

information are available from Maine Revenue at

•

Maine requires distillate reporting in “gross” gallons. Reporting should be on a calendar month basis.

•

Records are required to be retained for a period of at least six years.

•

Instructions specific to low-energy fuel are provided after instructions for Special Fuel Supplier reporting.

RECEIPTS – DISTILLATES

Line 1a – Beginning Inventory. Total gallons in bulk storage at the beginning of the reporting period. (Do not include

gallons in a retail tank). If there are multiple products, combine all inventories. Inventories should not be negative.

L

ine 2a – Gallons Received – Tax Paid. Gallons received from any source on which Maine excise tax has been paid.

Attach Schedule 1 for each fuel type. A credit for excise tax paid is taken on line 28a.

Line 3a – Gallons Recei

ved – Tax Unpaid. Gallons received from sources within Maine. Attach Schedule 2 for each

fuel type.

Line 4a –

Gallons Imported – Direct to Customer. Gallons imported to Maine, tax exempt, which were delivered

directly to a customer in Maine. Attach Schedule 3 for each fuel type.

Line 5a – Ga

llons Imported – Bulk Storage. Gallons received from outside Maine, tax exempt, delivered into your bulk

storage. Attach Schedule 4 for each fuel type.

Line 6a – Total Receipts. Add lines 2a, 3a, 4a and 5a.

Line 7a – Available Gallons. Line 1a (Beginning Inventory) plus Line 6a (Total Receipts).

Line 8a – Ending Inventory.

Gallons in inventory at the end of the month. If there are multiple products, combine all

inventories. Inventories should not be negative.

L

ine 9a – Accountable Gallons. Line 7a (Available Gallons) minus Line 8a (Ending Inventory).

Page 1 of 5

Last Updated: May 2008

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6