Print and Reset Form

Reset Form

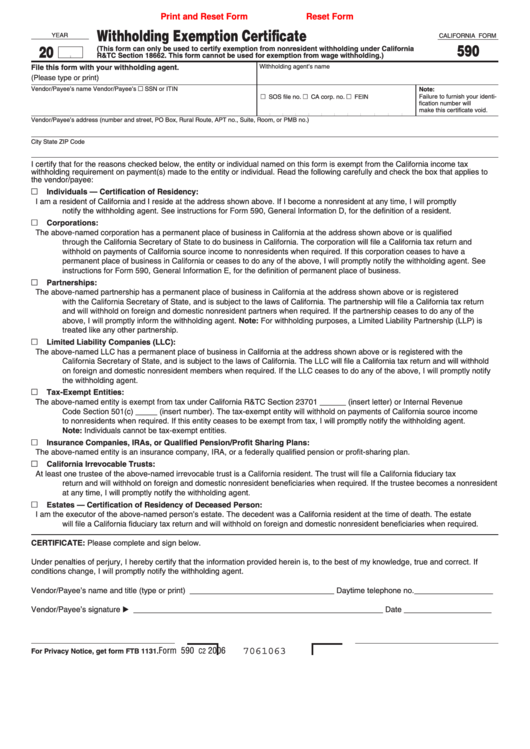

Withholding Exemption Certificate

YEAR

CALIFORNIA FORM

590

20

(This form can only be used to certify exemption from nonresident withholding under California

R&TC Section 18662. This form cannot be used for exemption from wage withholding.)

File this form with your withholding agent.

Withholding agent’s name

(Please type or print)

Vendor/Payee’s name

Vendor/Payee’s

SSN or ITIN

Note:

SOS file no.

CA corp. no. FEIN

Failure to furnish your identi-

fication number will

make this certificate void.

Vendor/Payee’s address (number and street, PO Box, Rural Route, APT no., Suite, Room, or PMB no.)

City

State

ZIP Code

I certify that for the reasons checked below, the entity or individual named on this form is exempt from the California income tax

withholding requirement on payment(s) made to the entity or individual. Read the following carefully and check the box that applies to

the vendor/payee:

Individuals — Certification of Residency:

I am a resident of California and I reside at the address shown above. If I become a nonresident at any time, I will promptly

notify the withholding agent. See instructions for Form 590, General Information D, for the definition of a resident.

Corporations:

The above-named corporation has a permanent place of business in California at the address shown above or is qualified

through the California Secretary of State to do business in California. The corporation will file a California tax return and

withhold on payments of California source income to nonresidents when required. If this corporation ceases to have a

permanent place of business in California or ceases to do any of the above, I will promptly notify the withholding agent. See

instructions for Form 590, General Information E, for the definition of permanent place of business.

Partnerships:

The above-named partnership has a permanent place of business in California at the address shown above or is registered

with the California Secretary of State, and is subject to the laws of California. The partnership will file a California tax return

and will withhold on foreign and domestic nonresident partners when required. If the partnership ceases to do any of the

above, I will promptly inform the withholding agent. Note: For withholding purposes, a Limited Liability Partnership (LLP) is

treated like any other partnership.

Limited Liability Companies (LLC):

The above-named LLC has a permanent place of business in California at the address shown above or is registered with the

California Secretary of State, and is subject to the laws of California. The LLC will file a California tax return and will withhold

on foreign and domestic nonresident members when required. If the LLC ceases to do any of the above, I will promptly notify

the withholding agent.

Tax-Exempt Entities:

The above-named entity is exempt from tax under California R&TC Section 23701 ______ (insert letter) or Internal Revenue

Code Section 501(c) _____ (insert number). The tax-exempt entity will withhold on payments of California source income

to nonresidents when required. If this entity ceases to be exempt from tax, I will promptly notify the withholding agent.

Note: Individuals cannot be tax-exempt entities.

Insurance Companies, IRAs, or Qualified Pension/Profit Sharing Plans:

The above-named entity is an insurance company, IRA, or a federally qualified pension or profit-sharing plan.

California Irrevocable Trusts:

At least one trustee of the above-named irrevocable trust is a California resident. The trust will file a California fiduciary tax

return and will withhold on foreign and domestic nonresident beneficiaries when required. If the trustee becomes a nonresident

at any time, I will promptly notify the withholding agent.

Estates — Certification of Residency of Deceased Person:

I am the executor of the above-named person’s estate. The decedent was a California resident at the time of death. The estate

will file a California fiduciary tax return and will withhold on foreign and domestic nonresident beneficiaries when required.

CERTIFICATE: Please complete and sign below.

Under penalties of perjury, I hereby certify that the information provided herein is, to the best of my knowledge, true and correct. If

conditions change, I will promptly notify the withholding agent.

Vendor/Payee’s name and title (type or print) _________________________________ Daytime telephone no.__________________

Vendor/Payee’s signature _________________________________________________________ Date ____________________

Form 590

2006

7061063

For Privacy Notice, get form FTB 1131.

C2

1

1