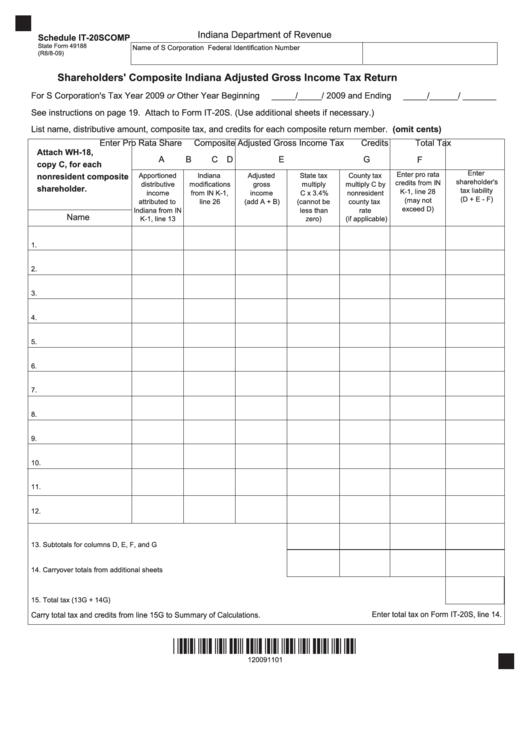

Form 49188 - Shareholders' Composite Indiana Adjusted Gross Income Tax Return

ADVERTISEMENT

Indiana Department of Revenue

Schedule IT-20SCOMP

State Form 49188

Name of S Corporation

Federal Identification Number

(R8/8-09)

Shareholders' Composite Indiana Adjusted Gross Income Tax Return

For S Corporation's Tax Year 2009 or Other Year Beginning

_____/_____/ 2009 and Ending

_____/______/ _______

See instructions on page 19. Attach to Form IT-20S. (Use additional sheets if necessary.)

List name, distributive amount, composite tax, and credits for each composite return member. (omit cents)

Enter Pro Rata Share Composite Adjusted Gross Income Tax Credits Total Tax

Attach WH-18,

A

B

C

D

E

G

F

copy C, for each

Enter

Enter pro rata

nonresident composite

Apportioned

Indiana

Adjusted

State tax

County tax

shareholder's

credits from IN

distributive

modifications

gross

multiply

multiply C by

shareholder.

tax liability

K-1, line 28

income

from IN K-1,

income

C x 3.4%

nonresident

(D + E - F)

(may not

attributed to

line 26

(add A + B)

(cannot be

county tax

exceed D)

Indiana from IN

less than

rate

Name

K-1, line 13

zero)

(if applicable)

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13. Subtotals for columns D, E, F, and G . .................................................................

14. Carryover totals from additional sheets ..............................................................

15. Total tax (13G + 14G) ............................................................................................................................................................................

Enter total tax on Form IT-20S, line 14.

Carry total tax and credits from line 15G to Summary of Calculations.

*120091101*

120091101

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1