Form An 2008 - Special Instructions For Stimulus Depreciation

ADVERTISEMENT

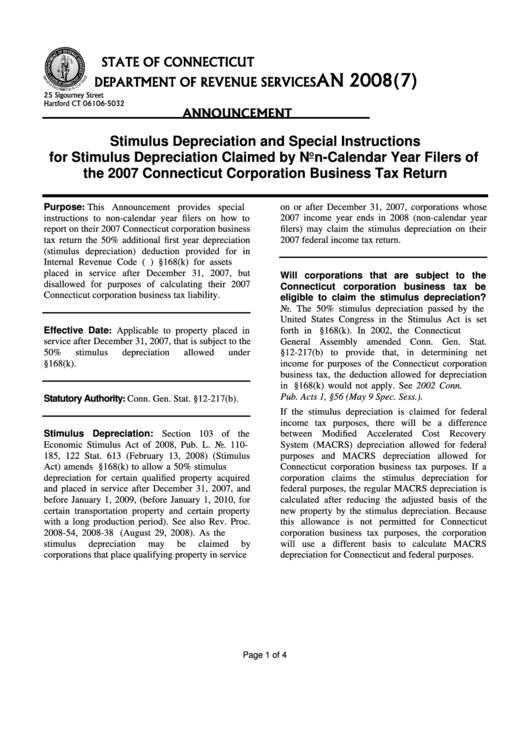

STATE OF CONNECTICUT

AN 2008(7)

DEPARTMENT OF REVENUE SERVICES

25 Sigourney Street

Hartford CT 06106-5032

ANNOUNCEMENT

Stimulus Depreciation and Special Instructions

for Stimulus Depreciation Claimed by Non-Calendar Year Filers of

the 2007 Connecticut Corporation Business Tax Return

Purpose: This Announcement provides special

on or after December 31, 2007, corporations whose

2007 income year ends in 2008 (non-calendar year

instructions to non-calendar year filers on how to

filers) may claim the stimulus depreciation on their

report on their 2007 Connecticut corporation business

tax return the 50% additional first year depreciation

2007 federal income tax return.

(stimulus depreciation) deduction provided for in

Internal Revenue Code (I.R.C.) §168(k) for assets

placed in service after December 31, 2007, but

Will corporations that are subject to the

disallowed for purposes of calculating their 2007

Connecticut corporation business tax be

Connecticut corporation business tax liability.

eligible to claim the stimulus depreciation?

No. The 50% stimulus depreciation passed by the

United States Congress in the Stimulus Act is set

Effective Date: Applicable to property placed in

forth in I.R.C. §168(k). In 2002, the Connecticut

service after December 31, 2007, that is subject to the

General Assembly amended Conn. Gen. Stat.

50%

stimulus

depreciation

allowed

under

§12-217(b) to provide that, in determining net

I.R.C. §168(k).

income for purposes of the Connecticut corporation

business tax, the deduction allowed for depreciation

in I.R.C. §168(k) would not apply. See 2002 Conn.

Pub. Acts 1, §56 (May 9 Spec. Sess.).

Statutory Authority: Conn. Gen. Stat. §12-217(b).

If the stimulus depreciation is claimed for federal

income tax purposes, there will be a difference

Stimulus Depreciation: Section 103 of the

between Modified Accelerated Cost Recovery

Economic Stimulus Act of 2008, Pub. L. No. 110-

System (MACRS) depreciation allowed for federal

185, 122 Stat. 613 (February 13, 2008) (Stimulus

purposes and MACRS depreciation allowed for

Act) amends I.R.C. §168(k) to allow a 50% stimulus

Connecticut corporation business tax purposes. If a

depreciation for certain qualified property acquired

corporation claims the stimulus depreciation for

and placed in service after December 31, 2007, and

federal purposes, the regular MACRS depreciation is

before January 1, 2009, (before January 1, 2010, for

calculated after reducing the adjusted basis of the

certain transportation property and certain property

new property by the stimulus depreciation. Because

with a long production period). See also Rev. Proc.

this allowance is not permitted for Connecticut

2008-54, 2008-38 I.R.B. (August 29, 2008). As the

corporation business tax purposes, the corporation

stimulus

depreciation

may

be

claimed

by

will use a different basis to calculate MACRS

corporations that place qualifying property in service

depreciation for Connecticut and federal purposes.

Page 1 of 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4