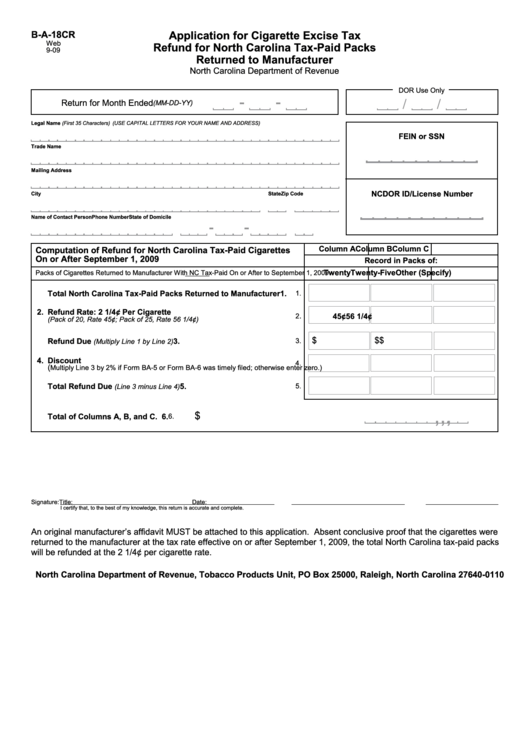

Form B-A-18cr - Application For Cigarette Excise Tax Refund For North Carolina Tax-Paid Packs Returned To Manufacturer

ADVERTISEMENT

Application for Cigarette Excise Tax

B-A-18CR

Web

Refund for North Carolina Tax-Paid Packs

9-09

Returned to Manufacturer

North Carolina Department of Revenue

DOR Use Only

Return for Month Ended

(MM-DD-YY)

Legal Name (First 35 Characters)

(USE CAPITAL LETTERS FOR YOUR NAME AND ADDRESS)

FEIN or SSN

Trade Name

Mailing Address

NCDOR ID/License Number

City

State

Zip Code

Name of Contact Person

Phone Number

State of Domicile

Column A

Column B

Column C

Computation of Refund for North Carolina Tax-Paid Cigarettes

On or After September 1, 2009

Record in Packs of:

Twenty

Twenty-Five

Other (Specify)

Packs of Cigarettes Returned to Manufacturer With NC Tax-Paid On or After to September 1, 2009

1.

Total North Carolina Tax-Paid Packs Returned to Manufacturer

1.

2.

Refund Rate: 2 1/4¢ Per Cigarette

.

45¢

56 1/4¢

2

(Pack of 20, Rate 45¢; Pack of 25, Rate 56 1/4¢)

$

$

$

3.

Refund Due

3.

(Multiply Line 1 by Line 2)

4.

Discount

4.

(

Multiply Line 3 by 2% if Form BA-5 or Form BA-6 was timely filed; otherwise enter zero.)

5.

Total Refund Due

5.

(Line 3 minus Line 4)

,

,

,

.

$

00

6.

Total of Columns A, B, and C.

6.

Signature:

Title:

Date:

I certify that, to the best of my knowledge, this return is accurate and complete.

An original manufacturer’s affidavit MUST be attached to this application. Absent conclusive proof that the cigarettes were

returned to the manufacturer at the tax rate effective on or after September 1, 2009, the total North Carolina tax-paid packs

will be refunded at the 2 1/4¢ per cigarette rate.

North Carolina Department of Revenue, Tobacco Products Unit, PO Box 25000, Raleigh, North Carolina 27640-0110

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1