Form 500 - Authorization To Disclose Tax Information & Designation Of Representative

ADVERTISEMENT

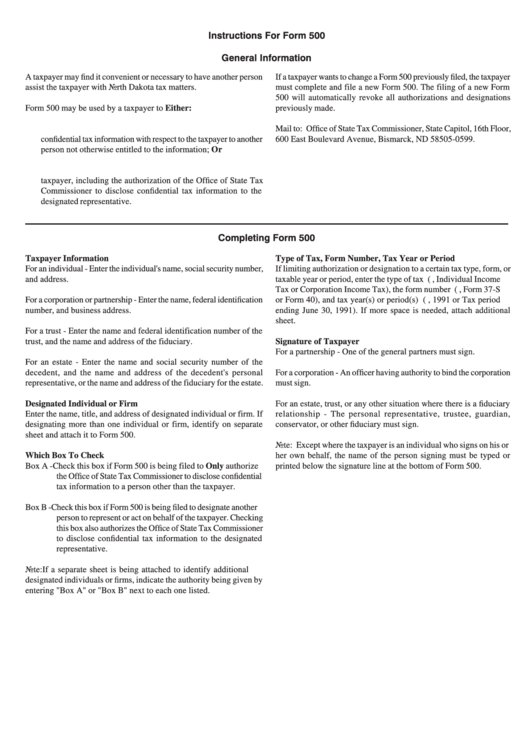

Instructions For Form 500

General Information

A taxpayer may find it convenient or necessary to have another person

If a taxpayer wants to change a Form 500 previously filed, the taxpayer

assist the taxpayer with North Dakota tax matters.

must complete and file a new Form 500. The filing of a new Form

500 will automatically revoke all authorizations and designations

Form 500 may be used by a taxpayer to Either:

previously made.

1. Authorize the Office of State Tax Commissioner to disclose

Mail to: Office of State Tax Commissioner, State Capitol, 16th Floor,

confidential tax information with respect to the taxpayer to another

600 East Boulevard Avenue, Bismarck, ND 58505-0599.

person not otherwise entitled to the information; Or

2. Designate another person to represent or act on behalf of the

taxpayer, including the authorization of the Office of State Tax

Commissioner to disclose confidential tax information to the

designated representative.

Completing Form 500

Taxpayer Information

Type of Tax, Form Number, Tax Year or Period

For an individual - Enter the individual's name, social security number,

If limiting authorization or designation to a certain tax type, form, or

and address.

taxable year or period, enter the type of tax (e.g., Individual Income

Tax or Corporation Income Tax), the form number (e.g., Form 37-S

For a corporation or partnership - Enter the name, federal identification

or Form 40), and tax year(s) or period(s) (e.g., 1991 or Tax period

number, and business address.

ending June 30, 1991). If more space is needed, attach additional

sheet.

For a trust - Enter the name and federal identification number of the

trust, and the name and address of the fiduciary.

Signature of Taxpayer

For a partnership - One of the general partners must sign.

For an estate - Enter the name and social security number of the

decedent, and the name and address of the decedent's personal

For a corporation - An officer having authority to bind the corporation

representative, or the name and address of the fiduciary for the estate.

must sign.

Designated Individual or Firm

For an estate, trust, or any other situation where there is a fiduciary

Enter the name, title, and address of designated individual or firm. If

relationship - The personal representative, trustee, guardian,

designating more than one individual or firm, identify on separate

conservator, or other fiduciary must sign.

sheet and attach it to Form 500.

Note: Except where the taxpayer is an individual who signs on his or

Which Box To Check

her own behalf, the name of the person signing must be typed or

Box A - Check this box if Form 500 is being filed to Only authorize

printed below the signature line at the bottom of Form 500.

the Office of State Tax Commissioner to disclose confidential

tax information to a person other than the taxpayer.

Box B - Check this box if Form 500 is being filed to designate another

person to represent or act on behalf of the taxpayer. Checking

this box also authorizes the Office of State Tax Commissioner

to disclose confidential tax information to the designated

representative.

Note:

If a separate sheet is being attached to identify additional

designated individuals or firms, indicate the authority being given by

entering "Box A" or "Box B" next to each one listed.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1