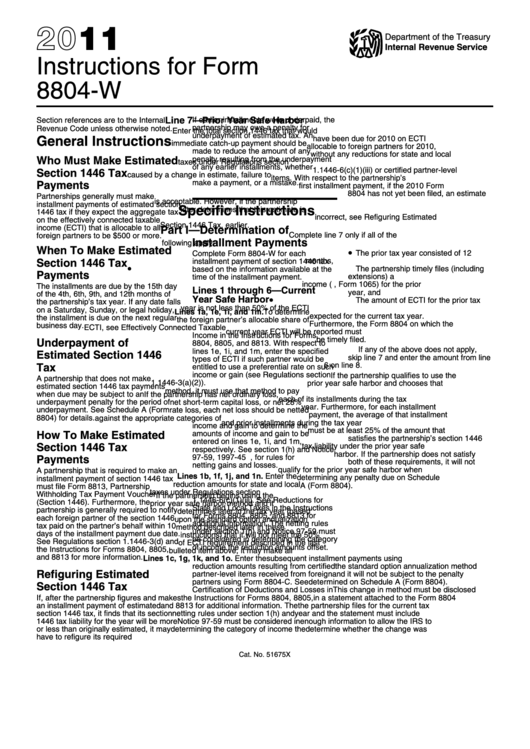

Instructions For Form 8804-W - Installment Payments Of Section 1446 Tax For Partnerships - Internal Revenue Service - 2011

ADVERTISEMENT

2011

Department of the Treasury

Internal Revenue Service

Instructions for Form

8804-W

Line 7—Prior Year Safe Harbor

If earlier installments were underpaid, the

Section references are to the Internal

partnership may owe a penalty for

Revenue Code unless otherwise noted.

Enter the total section 1446 tax that would

underpayment of estimated tax. An

General Instructions

have been due for 2010 on ECTI

immediate catch-up payment should be

allocable to foreign partners for 2010,

made to reduce the amount of any

without any reductions for state and local

Who Must Make Estimated

penalty resulting from the underpayment

taxes under Regulations section

of any earlier installments, whether

1.1446-6(c)(1)(iii) or certified partner-level

Section 1446 Tax

caused by a change in estimate, failure to

items. With respect to the partnership’s

make a payment, or a mistake.

Payments

first installment payment, if the 2010 Form

8804 has not yet been filed, an estimate

Partnerships generally must make

is acceptable. However, if the partnership

installment payments of estimated section

Specific Instructions

later determines that this estimate is

1446 tax if they expect the aggregate tax

incorrect, see Refiguring Estimated

on the effectively connected taxable

Section 1446 Tax, earlier.

income (ECTI) that is allocable to all

Part I—Determination of

Complete line 7 only if all of the

foreign partners to be $500 or more.

Installment Payments

following apply:

When To Make Estimated

•

The prior tax year consisted of 12

Complete Form 8804-W for each

Section 1446 Tax

months,

installment payment of section 1446 tax

•

The partnership timely files (including

based on the information available at the

Payments

extensions) a U.S. return of partnership

time of the installment payment.

income (e.g., Form 1065) for the prior

The installments are due by the 15th day

Lines 1 through 6—Current

year, and

of the 4th, 6th, 9th, and 12th months of

Year Safe Harbor

•

The amount of ECTI for the prior tax

the partnership’s tax year. If any date falls

year is not less than 50% of the ECTI

on a Saturday, Sunday, or legal holiday,

Lines 1a, 1e, 1i, and 1m. To determine

expected for the current tax year.

the installment is due on the next regular

the foreign partner’s allocable share of

Furthermore, the Form 8804 on which the

business day.

ECTI, see Effectively Connected Taxable

current year ECTI will be reported must

Income in the Instructions for Forms

be timely filed.

Underpayment of

8804, 8805, and 8813. With respect to

If any of the above does not apply,

lines 1e, 1i, and 1m, enter the specified

Estimated Section 1446

skip line 7 and enter the amount from line

types of ECTI if such partner would be

Tax

6 on line 8.

entitled to use a preferential rate on such

income or gain (see Regulations section

If the partnership qualifies to use the

A partnership that does not make

1.1446-3(a)(2)).

prior year safe harbor and chooses that

estimated section 1446 tax payments

method, it must use that method to pay

when due may be subject to an

If the partnership has net ordinary loss,

each of its installments during the tax

underpayment penalty for the period of

net short-term capital loss, or net 28%

year. Furthermore, for each installment

underpayment. See Schedule A (Form

rate loss, each net loss should be netted

payment, the average of that installment

8804) for details.

against the appropriate categories of

and prior installments during the tax year

income and gain to determine the

must be at least 25% of the amount that

How To Make Estimated

amounts of income and gain to be

satisfies the partnership’s section 1446

entered on lines 1e, 1i, and 1m,

Section 1446 Tax

tax liability under the prior year safe

respectively. See section 1(h) and Notice

harbor. If the partnership does not satisfy

Payments

97-59, 1997-45 I.R.B. 7, for rules for

both of these requirements, it will not

netting gains and losses.

qualify for the prior year safe harbor when

A partnership that is required to make an

Lines 1b, 1f, 1j, and 1n. Enter the

determining any penalty due on Schedule

installment payment of section 1446 tax

reduction amounts for state and local

A (Form 8804).

must file Form 8813, Partnership

taxes under Regulations section

Withholding Tax Payment Voucher

If the partnership begins using the

1.1446-6(c)(1)(iii). See Reductions for

(Section 1446). Furthermore, the

prior year safe harbor method and it

State and Local Taxes in the Instructions

partnership is generally required to notify

determines later in the tax year (based

for Forms 8804, 8805, and 8813 for

each foreign partner of the section 1446

upon the standard option annualization

additional information. The netting rules

tax paid on the partner’s behalf within 10

method described later in these

under section 1(h) and Notice 97-59 must

days of the installment payment due date.

instructions) that it will not meet the 50%

be considered in determining the category

See Regulations section 1.1446-3(d) and

of ECTI requirement described in the last

of income the reduction amounts offset.

the Instructions for Forms 8804, 8805,

bulleted item above, it may make all

and 8813 for more information.

Lines 1c, 1g, 1k, and 1o. Enter the

subsequent installment payments using

reduction amounts resulting from certified

the standard option annualization method

Refiguring Estimated

partner-level items received from foreign

and it will not be subject to the penalty

partners using Form 8804-C. See

determined on Schedule A (Form 8804).

Section 1446 Tax

Certification of Deductions and Losses in

This change in method must be disclosed

If, after the partnership figures and makes

the Instructions for Forms 8804, 8805,

in a statement attached to the Form 8804

an installment payment of estimated

and 8813 for additional information. The

the partnership files for the current tax

section 1446 tax, it finds that its section

netting rules under section 1(h) and

year and the statement must include

1446 tax liability for the year will be more

Notice 97-59 must be considered in

enough information to allow the IRS to

or less than originally estimated, it may

determining the category of income the

determine whether the change was

have to refigure its required installments.

reduction amounts offset.

appropriate.

Cat. No. 51675X

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3