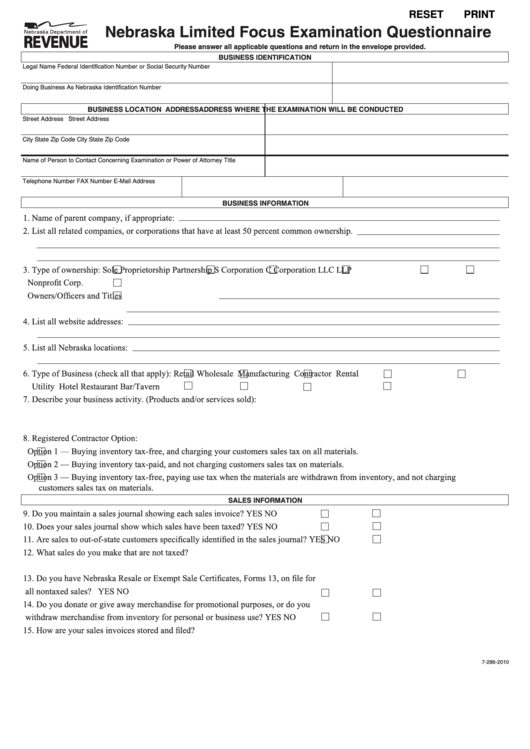

RESET

PRINT

Nebraska Limited Focus Examination Questionnaire

Please answer all applicable questions and return in the envelope provided.

BUSINESS IDENTIFICATION

Legal Name

Federal Identification Number or Social Security Number

Doing Business As

Nebraska Identification Number

BUSINESS LOCATION ADDRESS

ADDRESS WHERE THE EXAMINATION WILL BE CONDUCTED

Street Address

Street Address

City

State

Zip Code

City

State

Zip Code

Name of Person to Contact Concerning Examination or Power of Attorney

Title

Telephone Number

FAX Number

E-Mail Address

BUSINESS INFORMATION

1. Name of parent company, if appropriate:

2. List all related companies, or corporations that have at least 50 percent common ownership.

3. Type of ownership:

Sole Proprietorship

Partnership

S Corporation

C Corporation

LLC

LLP

Nonprofit Corp.

Owners/Officers and Titles

4. List all website addresses:

5. List all Nebraska locations:

6. Type of Business (check all that apply):

Retail

Wholesale

Manufacturing

Contractor

Rental

Utility

Hotel

Restaurant

Bar/Tavern

7. Describe your business activity. (Products and/or services sold):

8. Registered Contractor Option:

Option 1 — Buying inventory tax-free, and charging your customers sales tax on all materials.

Option 2 — Buying inventory tax-paid, and not charging customers sales tax on materials.

Option 3 — Buying inventory tax-free, paying use tax when the materials are withdrawn from inventory, and not charging

customers sales tax on materials.

SALES INFORMATION

9. Do you maintain a sales journal showing each sales invoice?

YES

NO

10. Does your sales journal show which sales have been taxed?

YES

NO

11. Are sales to out-of-state customers specifically identified in the sales journal?

YES

NO

12. What sales do you make that are not taxed?

13. Do you have Nebraska Resale or Exempt Sale Certificates, Forms 13, on file for

all nontaxed sales?

YES

NO

14. Do you donate or give away merchandise for promotional purposes, or do you

withdraw merchandise from inventory for personal or business use?

YES

NO

15. How are your sales invoices stored and filed?

7-286-2010

1

1 2

2