Form Eqr - Reconciliation Of City Income Tax Withheld From Wages - State Of Ohio

ADVERTISEMENT

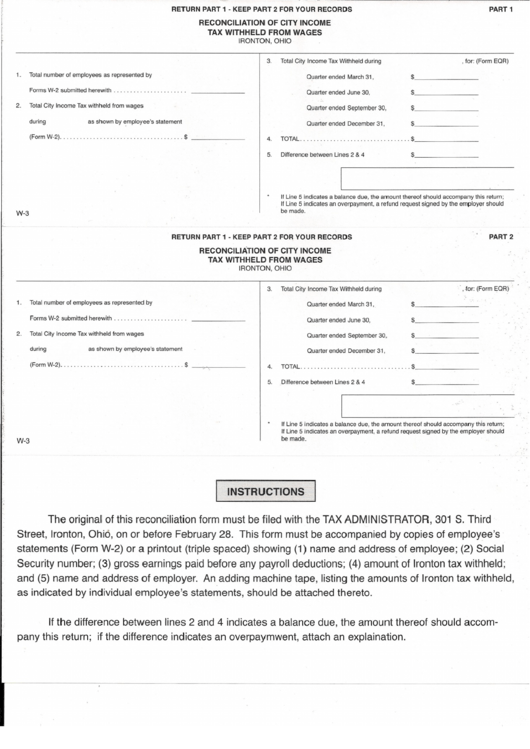

RETURN PART 1 - KEEP PART 2 FOR YOUR RECORDS

RECONCILIATION

OF CITY INCOME

TAX

WITHHELD

FROM

WAGES

IRONTON,

OHIO

PART 1

1.

Total

number of

employees

as

represented

by

Forms

W-2

submitted

herewith

_

.

2.

Total

City

Income

Tax

withheld from

wages

during

as shown

by

~mployee's

statement

(Form

W-2).

.

$------

W-3

3.

Total City

Income

Tax

Withheld during

, for:

(Form

EQR)

Ouarter

ended

March

31,

$

Quarter

ended

June

30,

$

Quarter ended

September

30,

$

Quarter

ended

December

31,

$

4.

TOTAL.

.

.

. .

. .

.

.

.

. . . . .

.

... $

5.

Difference

between

Lines 2 & 4

$

If Line 5 indicates a

balance

due,

the

amount thereof should accompany

this

return;

If

Line

5 indicates an

overpayment,

a refund request signed by the employer should

be made.

RETURN PART 1 - KEEP

PART

2

FO~

YOUR RECORDS

RECONCILIATION

OF CITY INCOME

TAX WITHHELD FROM WAGES

IRONTON,

OHIO

PART

2

1.

Total

number

of

employees

as

represented

by

Forms W-2

submitted

herewith.

.

. . .

. .

. . .

. .

. .

.

.

.

. . .

..

_

2.

Total

City

Income

Tax

withheld from

wages

during

as

shown

by

employee's

statement

(Form

W-2)

..

.

$

-~---

W-3

3.

Total City Income

Tax

Withheld during

.:

.for:

(Form

EQR)

Quarter

ended March

31

s

.

$------

Quarter ended

June

30,

$-------

$-------

Quarter

ended

September

30,

Quarter

ended

December

31,

$-------

4.

TOTAL

.

...

$-------

5.

Difference between

Lines

2

&

4

$-------

If Line 5 indicates a

balance

due,

the amount thereof should accompany

this return;

If Line 5 indicates an

overpayment,

a refund request signed by the employer should

be made.

INSTRUCTIONS

The original of this reconciliation

form

must be filed with the TAX

ADMINISTRATOR,

301 S. Third

Street,

Ironton,

Ohio,

on

or

before

February

28. This form must be accompanied by copies of

employee's·

statements (Form W-2) or a printout (triple spaced) showing (1) name and address of employee; (2) Social

Security number; (3) gross earnings paid before any payroll deductions; (4)

amount

of Ironton tax

withheld;

and (5) name and address of employer. An adding machine tape, listing the amounts of Ironton tax

withheld,

as indicated by individual employee's statements, should be attached thereto.

If the difference between lines 2 and 4 indicates a balance due, the amount thereof should accom-

pany this return; if the difference indicates an overpaymwent, attach an explaination.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1