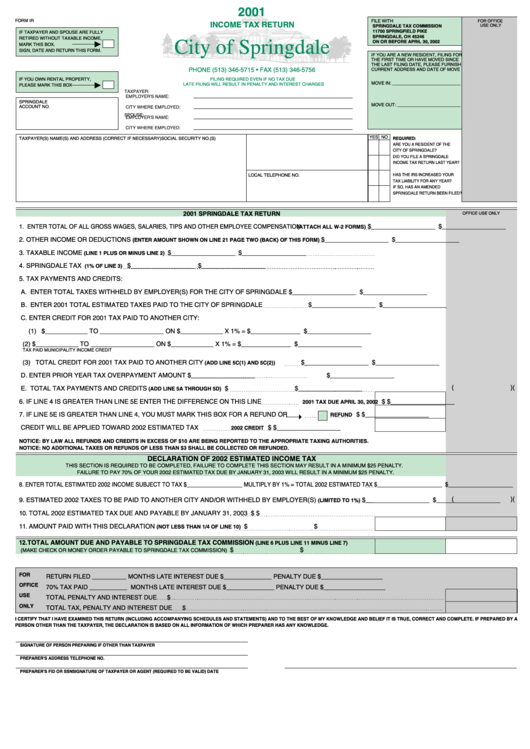

Form Ir - 2001 Income Tax Return

ADVERTISEMENT

2001

FORM IR

FILE WITH

FOR OFFICE

INCOME TAX RETURN

USE ONLY

SPRINGDALE TAX COMMISSION

11700 SPRINGFIELD PIKE

IF TAXPAYER AND SPOUSE ARE FULLY

City of Springdale

SPRINGDALE, OH 45246

RETIRED WITHOUT TAXABLE INCOME,

ON OR BEFORE APRIL 30, 2002

MARK THIS BOX.

SIGN, DATE AND RETURN THIS FORM.

IF YOU ARE A NEW RESIDENT, FILING FOR

THE FIRST TIME OR HAVE MOVED SINCE

THE LAST FILING DATE, PLEASE FURNISH

PHONE (513) 346-5715 • FAX (513) 346-5756

CURRENT ADDRESS AND DATE OF MOVE

IF YOU OWN RENTAL PROPERTY,

FILING REQUIRED EVEN IF NO TAX DUE

MOVE IN: ____________________________

LATE FILING WILL RESULT IN PENALTY AND INTEREST CHARGES

PLEASE MARK THIS BOX

TAXPAYER:

EMPLOYER'S NAME:

SPRINGDALE

MOVE OUT: __________________________

ACCOUNT NO.

CITY WHERE EMPLOYED:

SPOUSE:

EMPLOYER'S NAME:

CITY WHERE EMPLOYED:

YES NO

TAXPAYER(S) NAME(S) AND ADDRESS (CORRECT IF NECESSARY)

SOCIAL SECURITY NO.(S)

REQUIRED:

ARE YOU A RESIDENT OF THE

CITY OF SPRINGDALE?

DID YOU FILE A SPRINGDALE

INCOME TAX RETURN LAST YEAR?

LOCAL TELEPHONE NO.

HAS THE IRS INCREASED YOUR

TAX LIABILITY FOR ANY YEAR?

IF SO, HAS AN AMENDED

SPRINGDALE RETURN BEEN FILED?

2001 SPRINGDALE TAX RETURN

OFFICE USE ONLY

1. ENTER TOTAL OF ALL GROSS WAGES, SALARIES, TIPS AND OTHER EMPLOYEE COMPENSATION

$__________________ $__________________

(ATTACH ALL W-2 FORMS)

2. OTHER INCOME OR DEDUCTIONS

$__________________ $__________________

(ENTER AMOUNT SHOWN ON LINE 21 PAGE TWO (BACK) OF THIS FORM)

3. TAXABLE INCOME

$__________________ $__________________

(LINE 1 PLUS OR MINUS LINE 2)

4. SPRINGDALE TAX

$__________________ $__________________

(1% OF LINE 3)

5. TAX PAYMENTS AND CREDITS:

A. ENTER TOTAL TAXES WITHHELD BY EMPLOYER(S) FOR THE CITY OF SPRINGDALE

$__________________

$__________________

B. ENTER 2001 TOTAL ESTIMATED TAXES PAID TO THE CITY OF SPRINGDALE

$__________________

$__________________

C. ENTER CREDIT FOR 2001 TAX PAID TO ANOTHER CITY:

(1) $____________ TO __________________ ON $____________ X 1% =

$______________

$__________________

(2) $____________ TO __________________ ON $____________ X 1% =

$______________

$__________________

TAX PAID

MUNICIPALITY

INCOME

CREDIT

(3) TOTAL CREDIT FOR 2001 TAX PAID TO ANOTHER CITY

$__________________

$__________________

(ADD LINE 5C(1) AND 5C(2))

D. ENTER PRIOR YEAR TAX OVERPAYMENT AMOUNT

$__________________

$__________________

(

)

(

)

E. TOTAL TAX PAYMENTS AND CREDITS

$

$__________________

(ADD LINE 5A THROUGH 5D)

6. IF LINE 4 IS GREATER THAN LINE 5E ENTER THE DIFFERENCE ON THIS LINE

$

$__________________

2001 TAX DUE APRIL 30, 2002

7. IF LINE 5E IS GREATER THAN LINE 4, YOU MUST MARK THIS BOX FOR A REFUND OR

$

$__________________

REFUND

CREDIT WILL BE APPLIED TOWARD 2002 ESTIMATED TAX

$

$__________________

2002 CREDIT

NOTICE: BY LAW ALL REFUNDS AND CREDITS IN EXCESS OF $10 ARE BEING REPORTED TO THE APPROPRIATE TAXING AUTHORITIES.

NOTICE: NO ADDITIONAL TAXES OR REFUNDS OF LESS THAN $3 SHALL BE COLLECTED OR REFUNDED.

DECLARATION OF 2002 ESTIMATED INCOME TAX

THIS SECTION IS REQUIRED TO BE COMPLETED, FAILURE TO COMPLETE THIS SECTION MAY RESULT IN A MINIMUM $25 PENALTY.

FAILURE TO PAY 70% OF YOUR 2002 ESTIMATED TAX DUE BY JANUARY 31, 2003 WILL RESULT IN A MINIMUM $25 PENALTY.

8. ENTER TOTAL ESTIMATED 2002 INCOME SUBJECT TO TAX $__________________ MULTIPLY BY 1% = TOTAL 2002 ESTIMATED TAX

$_____________________ $_____________________

(

)

(

)

9. ESTIMATED 2002 TAXES TO BE PAID TO ANOTHER CITY AND/OR WITHHELD BY EMPLOYER(S)

$__________________ $__________________

(LIMITED TO 1%)

10.TOTAL 2002 ESTIMATED TAX DUE AND PAYABLE BY JANUARY 31, 2003

$

$

11.AMOUNT PAID WITH THIS DECLARATION

$

$

(NOT LESS THAN 1/4 OF LINE 10)

12.TOTAL AMOUNT DUE AND PAYABLE TO SPRINGDALE TAX COMMISSION

(LINE 6 PLUS LINE 11 MINUS LINE 7)

$

$

(MAKE CHECK OR MONEY ORDER PAYABLE TO SPRINGDALE TAX COMMISSION)

FOR

RETURN FILED __________ MONTHS LATE

INTEREST DUE $______________

PENALTY DUE $__________________

OFFICE

70% TAX PAID ___________ MONTHS LATE

INTEREST DUE $______________

PENALTY DUE $__________________

USE

TOTAL PENALTY AND INTEREST DUE

$

ONLY

TOTAL TAX, PENALTY AND INTEREST DUE

$

I CERTIFY THAT I HAVE EXAMINED THIS RETURN (INCLUDING ACCOMPANYING SCHEDULES AND STATEMENTS) AND TO THE BEST OF MY KNOWLEDGE AND BELIEF IT IS TRUE, CORRECT AND COMPLETE. IF PREPARED BY A

PERSON OTHER THAN THE TAXPAYER, THE DECLARATION IS BASED ON ALL INFORMATION OF WHICH PREPARER HAS ANY KNOWLEDGE.

SIGNATURE OF PERSON PREPARING IF OTHER THAN TAXPAYER

PREPARER'S ADDRESS

TELEPHONE NO.

PREPARER'S FID OR SSN

SIGNATURE OF TAXPAYER OR AGENT (REQUIRED TO BE VALID)

DATE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2