Schedule C, 1120, 1120s, Or 1065 - Profit Or Loss From Business Or Profession

ADVERTISEMENT

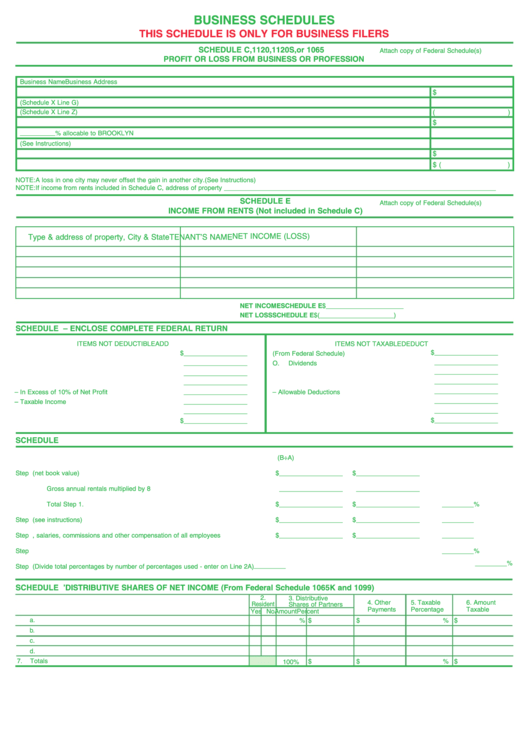

BUSINESS SCHEDULES

THIS SCHEDULE IS ONLY FOR BUSINESS FILERS

SCHEDULE C, 1120, 1120S, or 1065

Attach copy of Federal Schedule(s)

PROFIT OR LOSS FROM BUSINESS OR PROFESSION

Business Name

Business Address

1. Net Profit or Loss

$

2. Add Items not Deductible (Schedule X Line G)

3. Deduct Items not Taxable (Schedule X Line Z)

(

)

4. Adjusted Net Profit or Loss

$

5. Schedule Y __________ % allocable to BROOKLYN

6. Less allocable net loss carry-forward 5 year limit (See Instructions)

$

7. Net Profit

8. Net Loss

$ (

)

NOTE: A loss in one city may never offset the gain in another city. (See Instructions)

NOTE: If income from rents included in Schedule C, address of property _____________________________________________________________________________

SCHEDULE E

Attach copy of Federal Schedule(s)

INCOME FROM RENTS (Not included in Schedule C)

NET INCOME (LOSS)

Type & address of property, City & State

TENANT’S NAME

NET INCOME

SCHEDULE E ............................................ $______________________

NET LOSS

SCHEDULE E ............................................ $(_____________________)

SCHEDULE X. RECONCILIATION WITH FEDERAL INCOME TAX RETURN – ENCLOSE COMPLETE FEDERAL RETURN

ITEMS NOT DEDUCTIBLE

ADD

ITEMS NOT TAXABLE

DEDUCT

$__________________

A.

Capital Losses and Ordinary Losses

$__________________

N.

Capital Gains (From Federal Schedule)

$__________________

B.

Expenses Applicable to Non-Taxable Income

$__________________

O.

Dividends

$__________________

$__________________

C.

Taxes Based on Income

P.

Interest Income

$__________________

$__________________

D.

Guaranteed Payments to Partners

Q.

Royalty Income

$__________________

$__________________

E.

Contributions – In Excess of 10% of Net Profit

R.

Federal Schedule K – Allowable Deductions

$__________________

$__________________

F.

Federal Schedule K – Taxable Income

$__________________

$__________________

$__________________

$__________________

G.

Total Additions

Z.

Total Deductions

SCHEDULE Y. BUSINESS ALLOCATION FORMULA

A. Located Everywhere

B. Located in Brooklyn

C. Percentage (B÷A)

Step 1.

Average value of real and tangible personal property (net book value)

$__________________

$__________________

Gross annual rentals multiplied by 8

$__________________

$__________________

Total Step 1.

$__________________

$__________________

_________%

Step 2.

Gross receipts from sales and work or services performed (see instructions)

$__________________

$__________________

_________%

Step 3.

Total wages, salaries, commissions and other compensation of all employees

$__________________

$__________________

_________%

Step 4.

Total percentages

_________%

_________%

_________

Step 5.

Average percentage (Divide total percentages by number of percentages used - enter on Line 2A)

SCHEDULE Z. PARTNERS’ DISTRIBUTIVE SHARES OF NET INCOME (From Federal Schedule 1065K and 1099)

2.

3. Distributive

4. Other

5. Taxable

6. Amount

Resident

Shares of Partners

1.

Name and Address of Each Partner

Payments

Percentage

Taxable

Yes No

Percent

Amount

a.

%

$

$

%

$

b.

c.

d.

7.

Totals

$

$

%

$

100%

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1