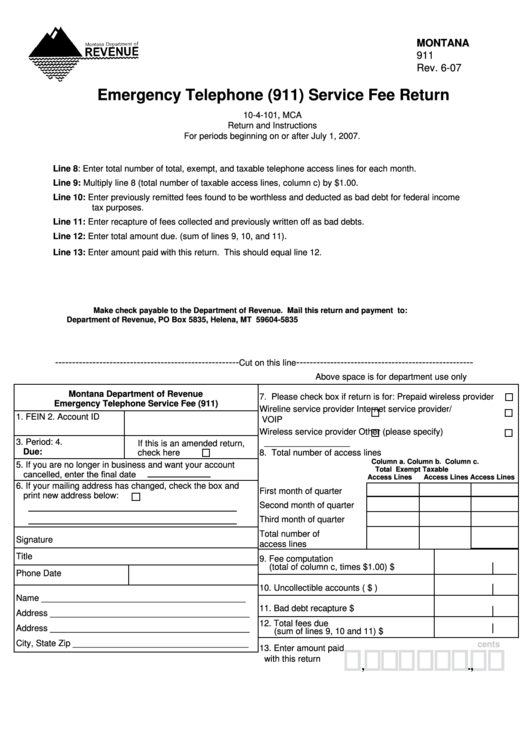

MONTANA

911

Rev. 6-07

Emergency Telephone (911) Service Fee Return

10-4-101, MCA

Return and Instructions

For periods beginning on or after July 1, 2007.

Line 8:

Enter total number of total, exempt, and taxable telephone access lines for each month.

Line 9:

Multiply line 8 (total number of taxable access lines, column c) by $1.00.

Line 10: Enter previously remitted fees found to be worthless and deducted as bad debt for federal income

tax purposes.

Line 11: Enter recapture of fees collected and previously written off as bad debts.

Line 12: Enter total amount due. (sum of lines 9, 10, and 11).

Line 13: Enter amount paid with this return. This should equal line 12.

Make check payable to the Department of Revenue. Mail this return and payment to:

Department of Revenue, PO Box 5835, Helena, MT 59604-5835

------------------------------------------------------

----------------------------------------------------

Cut on this line

Above space is for department use only

Montana Department of Revenue

7. Please check box if return is for: Prepaid wireless provider

Emergency Telephone Service Fee (911)

Wireline service provider

Internet service provider/

1. F EIN

2. Account ID

VOIP

Wireless service provider

Other (please specify)

3. P eriod:

4.

__________________

If this is an amended return,

Due:

check here

8. Total number of access lines

Column a.

Column b.

Column c.

5. I f you are no longer in business and want your account

Total

Exempt

Taxable

cancelled, enter the final date

Access Lines

Access Lines Access Lines

6. I f your mailing address has changed, check the box and

First month of quarter .........

print new address below:

Second month of quarter ....

Third month of quarter ........

Total number of

Signature

access lines ........................

Title

9. Fee computation

(total of column c, times $1.00)

$

Phone

Date

10. Uncollectible accounts

( $

)

Name ___________________________________________

11. Bad debt recapture

$

Address _ _________________________________________

12. Total fees due

Address _ _________________________________________

(sum of lines 9, 10 and 11)

$

City, State Zip _____________________________________

cents

13. Enter amount paid

with this return

,

,

.

1

1