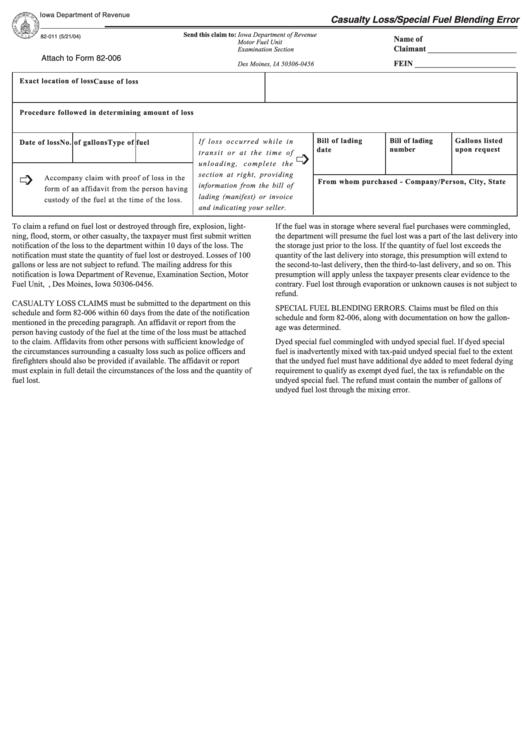

Form 82-011 - Casualty Loss/special Fuel Blending Error

ADVERTISEMENT

Iowa Department of Revenue

Casualty Loss/Special Fuel Blending Error

Send this claim to: Iowa Department of Revenue

82-011 (5/21/04)

Name of

Motor Fuel Unit

Claimant ______________________

Examination Section

Attach to Form 82-006

P.O. Box 10456

FEIN _________________________

Des Moines, IA 50306-0456

Exact location of loss

Cause of loss

Procedure followed in determining amount of loss

Bill of lading

Bill of lading

Gallons listed

I f l o s s o c c u r re d w h i l e i n

Date of loss

No. of gallons

Type of fuel

date

number

upon request

t r a n s i t o r a t t h e t i m e o f

u n l o a d i n g , c o m p l e t e t h e

section at right, providing

Accompany claim with proof of loss in the

From whom purchased - Company/Person, City, State

information from the bill of

form of an affidavit from the person having

lading (manifest) or invoice

custody of the fuel at the time of the loss.

and indicating your seller.

To claim a refund on fuel lost or destroyed through fire, explosion, light-

If the fuel was in storage where several fuel purchases were commingled,

ning, flood, storm, or other casualty, the taxpayer must first submit written

the department will presume the fuel lost was a part of the last delivery into

notification of the loss to the department within 10 days of the loss. The

the storage just prior to the loss. If the quantity of fuel lost exceeds the

notification must state the quantity of fuel lost or destroyed. Losses of 100

quantity of the last delivery into storage, this presumption will extend to

gallons or less are not subject to refund. The mailing address for this

the second-to-last delivery, then the third-to-last delivery, and so on. This

notification is Iowa Department of Revenue, Examination Section, Motor

presumption will apply unless the taxpayer presents clear evidence to the

Fuel Unit, P.O. Box 10456, Des Moines, Iowa 50306-0456.

contrary. Fuel lost through evaporation or unknown causes is not subject to

refund.

CASUALTY LOSS CLAIMS must be submitted to the department on this

SPECIAL FUEL BLENDING ERRORS. Claims must be filed on this

schedule and form 82-006 within 60 days from the date of the notification

schedule and form 82-006, along with documentation on how the gallon-

mentioned in the preceding paragraph. An affidavit or report from the

age was determined.

person having custody of the fuel at the time of the loss must be attached

to the claim. Affidavits from other persons with sufficient knowledge of

Dyed special fuel commingled with undyed special fuel. If dyed special

the circumstances surrounding a casualty loss such as police officers and

fuel is inadvertently mixed with tax-paid undyed special fuel to the extent

firefighters should also be provided if available. The affidavit or report

that the undyed fuel must have additional dye added to meet federal dying

must explain in full detail the circumstances of the loss and the quantity of

requirement to qualify as exempt dyed fuel, the tax is refundable on the

fuel lost.

undyed special fuel. The refund must contain the number of gallons of

undyed fuel lost through the mixing error.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1