Instructions For Wisconsin Sales And Use Tax Return - State Of Wisconsin

ADVERTISEMENT

INSTRUCTIONS FOR WISCONSIN SALES AND USE TAX RETURN

GENERAL INSTRUCTIONS

THIS RETURN IS TO BE USED BY TAXPAYERS FOR

REMINDER

REPORTING STATE, COUNTY, AND STADIUM SALES

AND USE TAXES.

• Do not take credit for previous overpayments against the

tax due on this return. To obtain a refund of your overpay-

If you are engaged in business at more than one location, even

ment, send a written request or an amended sales and use tax

though you must hold a separate seller’s permit for each

return to the address below.

location, you will receive and must file one consolidated sales

and use tax return. Include information and totals of all your

• Any Questions? Contact any Department of Revenue

business locations on this return.

office, write to the address below, contact the department in

Madison by telephone (608) 261-6261, fax (608) 267-1030,

STEPS TO FILING YOUR RETURN

or e-mail sales10@dor.state.wi.us, or visit our web site at

1. Read these instructions and enter the requested information

and amounts on the worksheet provided. NOTE: You

• Send all changes of name, address, ownership, and other

should keep the completed worksheet for your records for

account information to the Registration Unit at the

at least four years.

following:

2. Verify that the period entered on the top of the form is the

Wisconsin Department of Revenue

correct PERIOD COVERED for reporting your taxable

PO Box 8902

receipts and purchases.

Madison WI 53708-8902

3. Enter only the information and amounts from your

If your business operates at more than one location, specify

worksheet onto the sales and use tax return that was mailed

which location(s) had an ownership, name, or address

to you. Do not write account change information or ques-

change.

tions on this return.

• Write your seller's permit, use tax, or consumers use tax

4. This return must be filed when due, even if you have no tax

number on all correspondence and payments.

to report or are paying via EFT.

5. Mail the return and your check, if applicable, using the

labels provided to: WISCONSIN DEPARTMENT OF

REVENUE, BOX 93389, MILWAUKEE WI 53293-0389.

INSTRUCTIONS FOR LINES 1 THROUGH 14

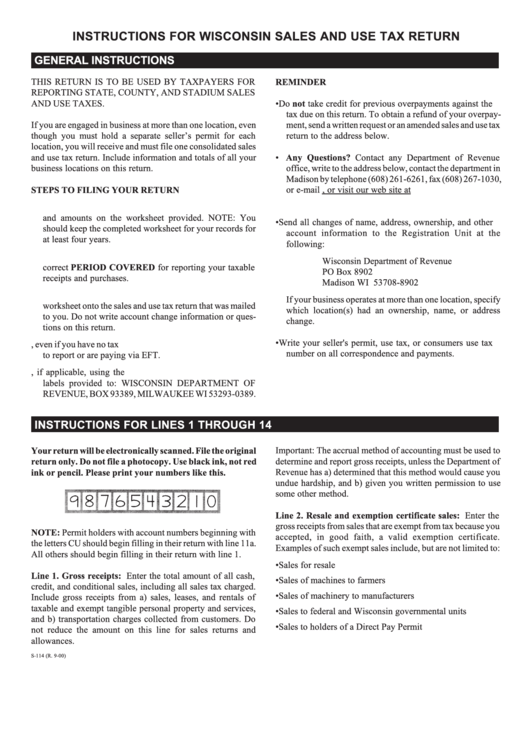

Your return will be electronically scanned. File the original

Important: The accrual method of accounting must be used to

return only. Do not file a photocopy. Use black ink, not red

determine and report gross receipts, unless the Department of

ink or pencil. Please print your numbers like this.

Revenue has a) determined that this method would cause you

undue hardship, and b) given you written permission to use

some other method.

Line 2. Resale and exemption certificate sales: Enter the

gross receipts from sales that are exempt from tax because you

NOTE: Permit holders with account numbers beginning with

accepted, in good faith, a valid exemption certificate.

the letters CU should begin filling in their return with line 11a.

Examples of such exempt sales include, but are not limited to:

All others should begin filling in their return with line 1.

• Sales for resale

Line 1. Gross receipts: Enter the total amount of all cash,

• Sales of machines to farmers

credit, and conditional sales, including all sales tax charged.

• Sales of machinery to manufacturers

Include gross receipts from a) sales, leases, and rentals of

taxable and exempt tangible personal property and services,

• Sales to federal and Wisconsin governmental units

and b) transportation charges collected from customers. Do

• Sales to holders of a Direct Pay Permit

not reduce the amount on this line for sales returns and

allowances.

S-114 (R. 9-00)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6