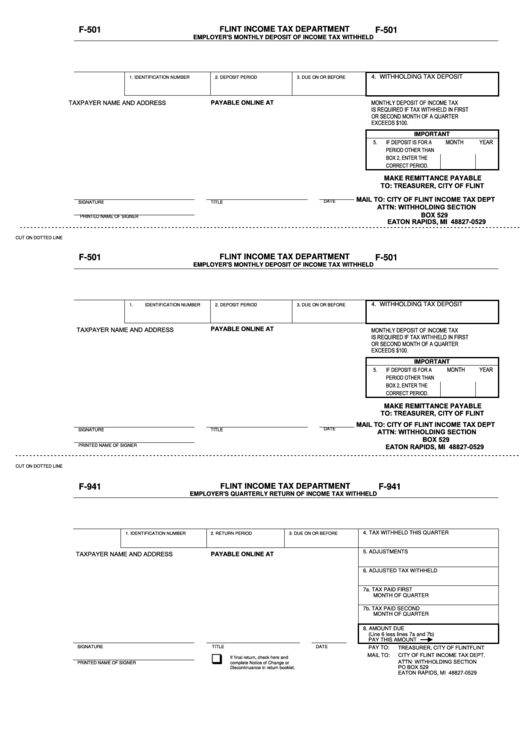

Form F-501 - Employer'S Monthly Deposit Of Income Tax Withheld

ADVERTISEMENT

F-501

FLINT INCOME TAX DEPARTMENT

F-501

EMPLOYER'S MONTHLY DEPOSIT OF INCOME TAX WITHHELD

4. WITHHOLDING TAX DEPOSIT

1. IDENTIFICATION NUMBER

2. DEPOSIT PERIOD

3. DUE ON OR BEFORE

PAYABLE ONLINE AT

TAXPAYER NAME AND ADDRESS

MONTHLY DEPOSIT OF INCOME TAX

IS REQUIRED IF TAX WITHHELD IN FIRST

OR SECOND MONTH OF A QUARTER

EXCEEDS $100.

IMPORTANT

5.

IF DEPOSIT IS FOR A

MONTH

YEAR

PERIOD OTHER THAN

BOX 2, ENTER THE

CORRECT PERIOD.

MAKE REMITTANCE PAYABLE

TO: TREASURER, CITY OF FLINT

MAIL TO: CITY OF FLINT INCOME TAX DEPT

SIGNATURE

TITLE

DATE

ATTN: WITHHOLDING SECTION

BOX 529

PRINTED NAME OF SIGNER

EATON RAPIDS, MI 48827-0529

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

CUT ON DOTTED LINE

F-501

FLINT INCOME TAX DEPARTMENT

F-501

EMPLOYER'S MONTHLY DEPOSIT OF INCOME TAX WITHHELD

4. WITHHOLDING TAX DEPOSIT

1.

IDENTIFICATION NUMBER

2. DEPOSIT PERIOD

3. DUE ON OR BEFORE

PAYABLE ONLINE AT

TAXPAYER NAME AND ADDRESS

MONTHLY DEPOSIT OF INCOME TAX

IS REQUIRED IF TAX WITHHELD IN FIRST

OR SECOND MONTH OF A QUARTER

EXCEEDS $100.

IMPORTANT

5.

IF DEPOSIT IS FOR A

MONTH

YEAR

PERIOD OTHER THAN

BOX 2, ENTER THE

CORRECT PERIOD.

MAKE REMITTANCE PAYABLE

TO: TREASURER, CITY OF FLINT

MAIL TO: CITY OF FLINT INCOME TAX DEPT

ATTN: WITHHOLDING SECTION

SIGNATURE

TITLE

DATE

BOX 529

EATON RAPIDS, MI 48827-0529

PRINTED NAME OF SIGNER

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

CUT ON DOTTED LINE

F-941

FLINT INCOME TAX DEPARTMENT

F-941

EMPLOYER'S QUARTERLY RETURN OF INCOME TAX WITHHELD

4. TAX WITHHELD THIS QUARTER

1. IDENTIFICATION NUMBER

2. RETURN PERIOD

3. DUE ON OR BEFORE

5. ADJUSTMENTS

TAXPAYER NAME AND ADDRESS

PAYABLE ONLINE AT

6. ADJUSTED TAX WITHHELD

7a. TAX PAID FIRST

MONTH OF QUARTER

7b. TAX PAID SECOND

MONTH OF QUARTER

8. AMOUNT DUE

(Line 6 less lines 7a and 7b)

PAY THIS AMOUNT

TREASURER, CITY OF FLINT FLINT

SIGNATURE

TITLE

DATE

PAY TO:

CITY OF FLINT INCOME TAX DEPT.

MAIL TO:

If final return, check here and

ATTN: WITHHOLDING SECTION

PRINTED NAME OF SIGNER

complete Notice of Change or

PO BOX 529

Discontinuance in return booklet.

EATON RAPIDS, MI 48827-0529

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1