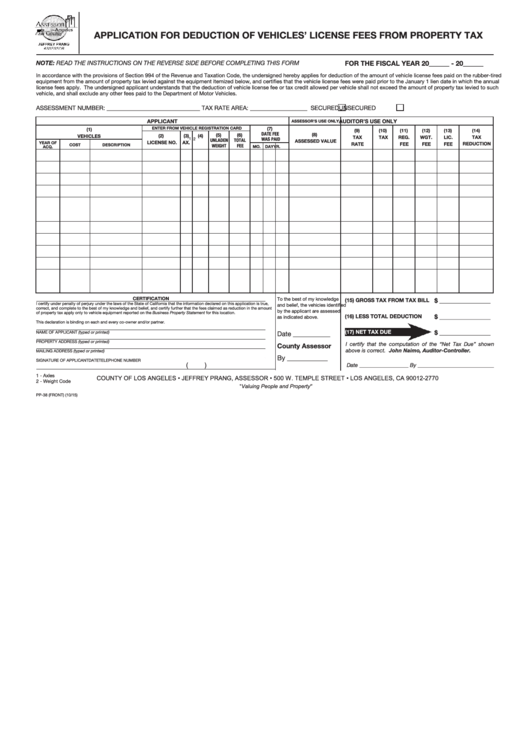

APPLICATION FOR DEDUCTION OF VEHICLES’ LICENSE FEES FROM PROPERTY TAX

NOTE: READ THE INSTRUCTIONS ON THE REVERSE SIDE BEFORE COMPLETING THIS FORM

FOR THE FISCAL YEAR 20______ - 20______

In accordance with the provisions of Section 994 of the Revenue and Taxation Code, the undersigned hereby applies for deduction of the amount of vehicle license fees paid on the rubber-tired

equipment from the amount of property tax levied against the equipment itemized below, and certifies that the vehicle license fees were paid prior to the January 1 lien date in which the annual

license fees apply. The undersigned applicant understands that the deduction of vehicle license fee or tax credit allowed per vehicle shall not exceed the amount of property tax levied to such

vehicle, and shall exclude any other fees paid to the Department of Motor Vehicles.

ASSESSMENT NUMBER: _______________________________ TAX RATE AREA: ___________________ SECURED

UNSECURED

APPLICANT

AUDITOR’S USE ONLY

ASSESSOR’S USE ONLY

ENTER FROM VEHICLE REGISTRATION CARD

(7)

(1)

(14)

(9)

(10)

(11)

(12)

(13)

DATE FEE

(8)

(5)

(6)

(2)

(3)

(4)

VEHICLES

TAX

TAX

REG.

WGT.

LIC.

TAX

1

2

WAS PAID

UNLADEN

TOTAL

ASSESSED VALUE

LICENSE NO.

AX.

W.C.

YEAR OF

REDUCTION

RATE

FEE

FEE

FEE

COST

DESCRIPTION

WEIGHT

FEE

MO.

DAY

YR.

ACQ.

CERTIFICATION

To the best of my knowledge

(15) GROSS TAX FROM TAX BILL

$ _________________

I certify under penalty of perjury under the laws of the State of California that the information declared on this application is true,

and belief, the vehicles identified

correct, and complete to the best of my knowledge and belief, and certify further that the fees claimed as reduction in the amount

by the applicant are assessed

of property tax apply only to vehicle equipment reported on the Business Property Statement for this location.

(16) LESS TOTAL DEDUCTION

$ _________________

as indicated above.

This declaration is binding on each and every co-owner and/or partner.

(17) NET TAX DUE

$ _________________

NAME OF APPLICANT (typed or printed)

Date ___________

PROPERTY ADDRESS (typed or printed)

I certify that the computation of the “Net Tax Due” shown

County Assessor

above is correct. John Naimo, Auditor-Controller.

MAILING ADDRESS (typed or printed)

By ____________

SIGNATURE OF APPLICANT

DATE

TELEPHONE NUMBER

(

)

Date __________________ By ____________________________

1 - Axles

COUNTY OF LOS ANGELES • JEFFREY PRANG, ASSESSOR • 500 W. TEMPLE STREET • LOS ANGELES, CA 90012-2770

2 - Weight Code

“Valuing People and Property”

PP-38 (FRONT) (10/15)

1

1 2

2