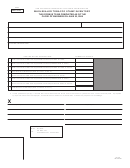

Dealer’s Name

Federal ID Number

Reporting Period (MMYYYY)

Schedule A

Invoice Date

Invoice Number

To Whom Sold or Shipped

Address

“Wholesale Price”

Cigar Schedule B

CATEGORY I. Tax on cigars with wholesale price of $2.17 or less

17. Wholesale value of cigars

(Multiply tax included price by .521) . . . . . . . 17. _______________________

18. Less: Exempt Sales (Shipped out of state) . . . 18. _______________________

19. Amount subject to tax

0.00

(Line 17 minus Line 18) . . . . . . . . . . . . . . . . . 19. _______________________

0.00

20. Tax Due (Line 19 x 92%). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20. ______________________

CATEGORY II. Tax on cigars with wholesale price of $2.18 - $9.99

21. Number of cigars sold . . . . . . . . . . . . . . . . . . . 21. _______________________

22. Less: Exempt Sales (Shipped out of state) . . . 22. _______________________

23. Total cigars subject to tax

0

(Line 21 minus Line 22) . . . . . . . . . . . . . . . . . 23. _______________________

0.00

24. Tax Due (Line 23 x $2.00) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24. ______________________

CATEGORY III. Tax on cigars with wholesale price of $10.00 or greater

25. Number of cigars sold . . . . . . . . . . . . . . . . . . . 25. _______________________

26. Less: Exempt Sales (Shipped out of state) . . . 26. _______________________

27. Total cigars subject to tax

0

(Line 25 minus Line 26) . . . . . . . . . . . . . . . . . 27. _______________________

0.00

28. Tax Due (Line 27 x $4.00) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28. ______________________

0.00

29. Total Tax Due (Add Lines 20, 24, and 28) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 29. ______________________

Transfer this amount to Form TO-641, Line 12 and attach this schedule to the report.

Save and go to

Clear ALL fields

Save and Print

Important Printing Instructions

Form TO-641

(Rev. 06/15)

1

1 2

2 3

3