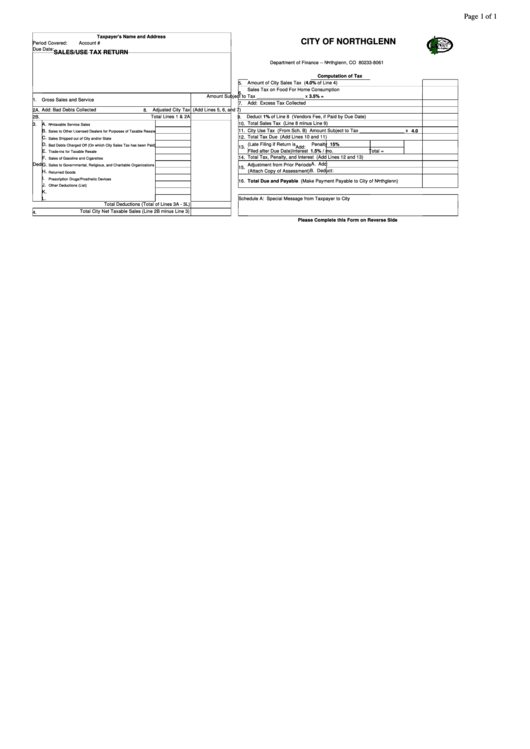

Sales/use Tax Return Sheet

ADVERTISEMENT

Page 1 of 1

Taxpayer's Name and Address

CITY OF NORTHGLENN

Period Covered:

Account #

Due Date:

SALES/USE TAX RETURN

Department of Finance - P.O. Box 330061 - Northglenn, CO 80233-8061

Computation of Tax

Amount of City Sales Tax (4.0% of Line 4)

5.

Sales Tax on Food For Home Consumption

6.

Amount Subject to Tax __________________ x 3.5% =

1.

Gross Sales and Service

Add: Excess Tax Collected

7.

2A. Add: Bad Debts Collected

Adjusted City Tax (Add Lines 5, 6, and 7)

8.

2B.

Total Lines 1 & 2A

9.

Deduct 1% of Line 8 (Vendors Fee, if Paid by Due Date)

10. Total Sales Tax (Line 8 minus Line 9)

3.

A.

Nontaxable Service Sales

B.

11. City Use Tax (From Sch. B) Amount Subject to Tax _________________ x 4.0

Sales to Other Licensed Dealers for Purposes of Taxable Resale

12. Total Tax Due (Add Lines 10 and 11)

C.

Sales Shipped out of City and/or State

D.

(Late Filing if Return is

Penalty 15%

Bad Debts Charged Off (On which City Sales Tax has been Paid)

13.

Add:

E.

Filed after Due Date)

Interest 1.5% / mo.

Total =

Trade-ins for Taxable Resale

14. Total Tax, Penalty, and Interest (Add Lines 12 and 13)

F.

Sales of Gasoline and Cigarettes

Deductions

A. Add:

G.

Adjustment from Prior Periods

Sales to Governmental, Religious, and Charitable Organizations

15.

B. Deduct:

H.

(Attach Copy of Assessment)

Returned Goods

I.

Prescription Drugs/Prosthetic Devices

16. Total Due and Payable (Make Payment Payable to City of Northglenn)

J.

Other Deductions (List)

K.

L.

Schedule A: Special Message from Taxpayer to City

Total Deductions (Total of Lines 3A - 3L)

Total City Net Taxable Sales (Line 2B minus Line 3)

4.

Please Complete this Form on Reverse Side

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2