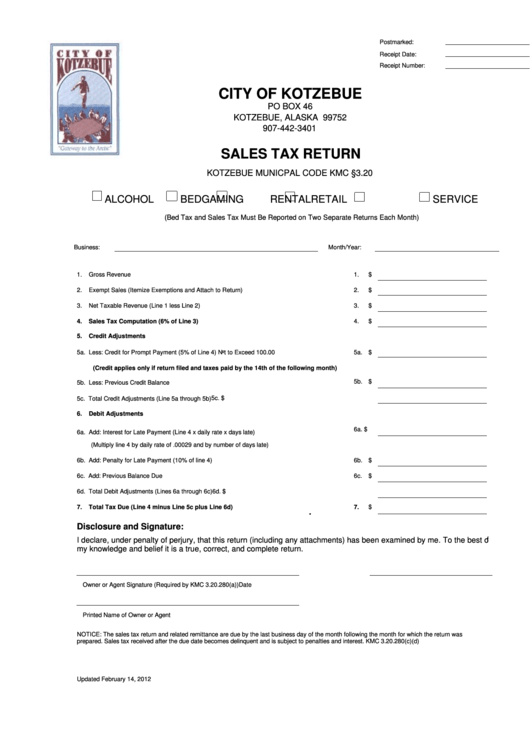

Postmarked:

Receipt Date:

Receipt Number:

CITY OF KOTZEBUE

PO BOX 46

KOTZEBUE, ALASKA 99752

907-442-3401

SALES TAX RETURN

KOTZEBUE MUNICPAL CODE KMC §3.20

ALCOHOL

BED

GAMING

RENTAL

RETAIL

SERVICE

(Bed Tax and Sales Tax Must Be Reported on Two Separate Returns Each Month)

Business:

Month/Year:

1.

Gross Revenue

1.

$

2.

Exempt Sales (Itemize Exemptions and Attach to Return)

2.

$

3.

Net Taxable Revenue (Line 1 less Line 2)

3.

$

4.

Sales Tax Computation (6% of Line 3)

4.

$

5.

Credit Adjustments

5a. Less: Credit for Prompt Payment (5% of Line 4) Not to Exceed 100.00

5a.

$

(Credit applies only if return filed and taxes paid by the 14th of the following month)

5b.

$

5b. Less: Previous Credit Balance

5c. $

5c. Total Credit Adjustments (Line 5a through 5b)

6.

Debit Adjustments

6a. $

6a. Add: Interest for Late Payment (Line 4 x daily rate x days late)

(Multiply line 4 by daily rate of .00029 and by number of days late)

6b. Add: Penalty for Late Payment (10% of line 4)

6b.

$

6c. Add: Previous Balance Due

6c.

$

6d. Total Debit Adjustments (Lines 6a through 6c)

6d. $

7.

Total Tax Due (Line 4 minus Line 5c plus Line 6d)

7.

$

Disclosure and Signature:

I declare, under penalty of perjury, that this return (including any attachments) has been examined by me. To the best of

my knowledge and belief it is a true, correct, and complete return.

Owner or Agent Signature (Required by KMC 3.20.280(a))

Date

Printed Name of Owner or Agent

NOTICE: The sales tax return and related remittance are due by the last business day of the month following the month for which the return was

prepared. Sales tax received after the due date becomes delinquent and is subject to penalties and interest. KMC 3.20.280(c)(d)

Updated February 14, 2012

1

1 2

2