Form Mdes-13 - Report To Determine Liability For Unemployment Tax - Agricultural - 2001

ADVERTISEMENT

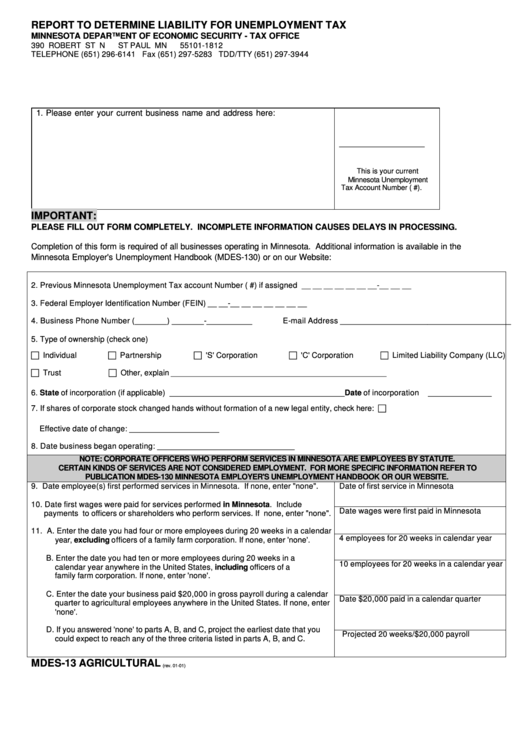

REPORT TO DETERMINE LIABILITY FOR UNEMPLOYMENT TAX

MINNESOTA DEPARTMENT OF ECONOMIC SECURITY - TAX OFFICE

390 ROBERT ST N

ST PAUL MN

55101-1812

TELEPHONE (651) 296-6141 Fax (651) 297-5283 TDD/TTY (651) 297-3944

1. Please enter your current business name and address here:

___________________

This is your current

Minnesota Unemployment

Tax Account Number (U.C.#).

IMPORTANT:

PLEASE FILL OUT FORM COMPLETELY. INCOMPLETE INFORMATION CAUSES DELAYS IN PROCESSING.

Completion of this form is required of all businesses operating in Minnesota. Additional information is available in the

Minnesota Employer's Unemployment Handbook (MDES-130) or on our Website:

2. Previous Minnesota Unemployment Tax account Number (U.C.#) if assigned __ __ __ __ __ __ __-__ __ __

3. Federal Employer Identification Number (FEIN) __ __-__ __ __ __ __ __ __

4. Business Phone Number (_______) _______-__________

E-mail Address ________________________________________

5. Type of ownership (check one)

c Individual

c Partnership

c 'S' Corporation

c 'C' Corporation

c Limited Liability Company (LLC)

c Trust

c Other, explain _______________________________________________

6. State of incorporation (if applicable) _______________________________________Date of incorporation ______________

7. If shares of corporate stock changed hands without formation of a new legal entity, check here: c

Effective date of change: ____________________

8. Date business began operating: ______________________________

NOTE: CORPORATE OFFICERS WHO PERFORM SERVICES IN MINNESOTA ARE EMPLOYEES BY STATUTE.

CERTAIN KINDS OF SERVICES ARE NOT CONSIDERED EMPLOYMENT. FOR MORE SPECIFIC INFORMATION REFER TO

PUBLICATION MDES-130 MINNESOTA EMPLOYER'S UNEMPLOYMENT HANDBOOK OR OUR WEBSITE.

9. Date employee(s) first performed services in Minnesota. If none, enter "none".

Date of first service in Minnesota

10. Date first wages were paid for services performed in Minnesota. Include

Date wages were first paid in Minnesota

payments to officers or shareholders who perform services. If none, enter "none".

11. A. Enter the date you had four or more employees during 20 weeks in a calendar

4 employees for 20 weeks in calendar year

year, excluding officers of a family farm corporation. If none, enter 'none'.

B. Enter the date you had ten or more employees during 20 weeks in a

10 employees for 20 weeks in a calendar year

calendar year anywhere in the United States, including officers of a

family farm corporation. If none, enter 'none'.

C. Enter the date your business paid $20,000 in gross payroll during a calendar

Date $20,000 paid in a calendar quarter

quarter to agricultural employees anywhere in the United States. If none, enter

'none'.

D. If you answered 'none' to parts A, B, and C, project the earliest date that you

Projected 20 weeks/$20,000 payroll

could expect to reach any of the three criteria listed in parts A, B, and C.

MDES-13 AGRICULTURAL

(rev. 01-01)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2