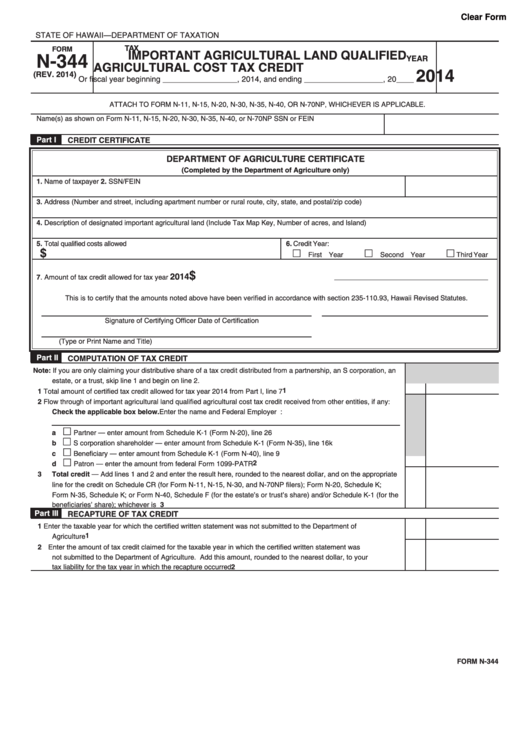

Form N-344 - Important Agricultural Land Qualified Agricultural Cost Tax Credit - 2014

ADVERTISEMENT

Clear Form

STATE OF HAWAII—DEPARTMENT OF TAXATION

TAX

FORM

IMPORTANT AGRICULTURAL LAND QUALIFIED

N-344

YEAR

AGRICULTURAL COST TAX CREDIT

2014

(REV. 2014)

Or fiscal year beginning _________________, 2014, and ending __________________, 20____

ATTACH TO FORM N-11, N-15, N-20, N-30, N-35, N-40, OR N-70NP, WHICHEVER IS APPLICABLE.

Name(s) as shown on Form N-11, N-15, N-20, N-30, N-35, N-40, or N-70NP

SSN or FEIN

Part I

CREDIT CERTIFICATE

DEPARTMENT OF AGRICULTURE CERTIFICATE

(Completed by the Department of Agriculture only)

1. Name of taxpayer

2. SSN/FEIN

3. Address (Number and street, including apartment number or rural route, city, state, and postal/zip code)

4. Description of designated important agricultural land (Include Tax Map Key, Number of acres, and Island)

5. Total qualified costs allowed

6. Credit Year:

$

First Year

Second Year

Third Year

$

2014 .........................................................

7. Amount of tax credit allowed for tax year

This is to certify that the amounts noted above have been verified in accordance with section 235-110.93, Hawaii Revised Statutes.

Signature of Certifying Officer

Date of Certification

(Type or Print Name and Title)

Part II

COMPUTATION OF TAX CREDIT

Note: If you are only claiming your distributive share of a tax credit distributed from a partnership, an S corporation, an

estate, or a trust, skip line 1 and begin on line 2.

1

1

Total amount of certified tax credit allowed for tax year 2014 from Part I, line 7 ..........................................................

2

Flow through of important agricultural land qualified agricultural cost tax credit received from other entities, if any:

Check the applicable box below. Enter the name and Federal Employer I.D. No. of Entity:

a

Partner — enter amount from Schedule K-1 (Form N-20), line 26 ...................................................................

b

S corporation shareholder — enter amount from Schedule K-1 (Form N-35), line 16k ....................................

c

Beneficiary — enter amount from Schedule K-1 (Form N-40), line 9 ...............................................................

2

d

Patron — enter the amount from federal Form 1099-PATR ..............................................................................

3

Total credit — Add lines 1 and 2 and enter the result here, rounded to the nearest dollar, and on the appropriate

line for the credit on Schedule CR (for Form N-11, N-15, N-30, and N-70NP filers); Form N-20, Schedule K;

Form N-35, Schedule K; or Form N-40, Schedule F (for the estate’s or trust’s share) and/or Schedule K-1 (for the

3

beneficiaries’ share); whichever is applicable...............................................................................................................

Part III

RECAPTURE OF TAX CREDIT

1

Enter the taxable year for which the certified written statement was not submitted to the Department of

1

Agriculture ....................................................................................................................................................................

2

Enter the amount of tax credit claimed for the taxable year in which the certified written statement was

not submitted to the Department of Agriculture. Add this amount, rounded to the nearest dollar, to your

2

tax liability for the tax year in which the recapture occurred ........................................................................................

FORM N-344

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2