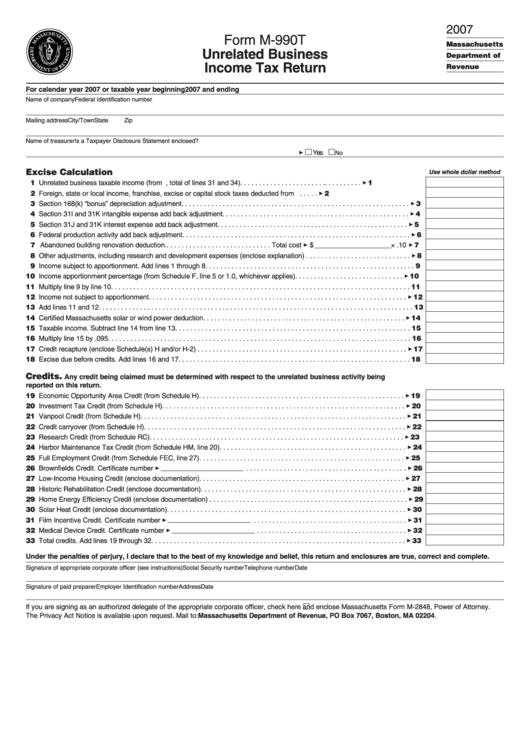

Form M-990t - Unrelated Business Income Tax Return - 2007

ADVERTISEMENT

2007

Form M-990T

Massachusetts

Unrelated Business

Department of

Income Tax Return

Revenue

For calendar year 2007 or taxable year beginning

2007 and ending

Name of company

Federal Identification number

Mailing address

City/Town

State

Zip

Name of treasurer

Is a Taxpayer Disclosure Statement enclosed?

Yes

No

3

Excise Calculation

Use whole dollar method

01 Unrelated business taxable income (from U.S. Form 990T, total of lines 31 and 34) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 1

02 Foreign, state or local income, franchise, excise or capital stock taxes deducted from U.S. net income. . . . . . . . . . . . . . . . . . 3 2

03 Section 168(k) “bonus” depreciation adjustment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 3

04 Section 31I and 31K intangible expense add back adjustment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 4

05 Section 31J and 31K interest expense add back adjustment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 5

06 Federal production activity add back adjustment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 6

07 Abandoned building renovation deduction. . . . . . . . . . . . . . . . . . . . . . . . . . . . . Total cost 3 $ ____________________ × .10 3 7

08 Other adjustments, including research and development expenses (enclose explanation) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 8

09 Income subject to apportionment. Add lines 1 through 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

10 Income apportionment percentage (from Schedule F, line 5 or 1.0, whichever applies) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 10

11 Multiply line 9 by line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12 Income not subject to apportionment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 12

13 Add lines 11 and 12 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

14 Certified Massachusetts solar or wind power deduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 14

15 Taxable income. Subtract line 14 from line 13 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

16 Multiply line 15 by .095 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

17 Credit recapture (enclose Schedule(s) H and/or H-2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 17

18 Excise due before credits. Add lines 16 and 17 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

Credits.

Any credit being claimed must be determined with respect to the unrelated business activity being

reported on this return.

19 Economic Opportunity Area Credit (from Schedule H) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 19

20 Investment Tax Credit (from Schedule H) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 20

21 Vanpool Credit (from Schedule H) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 21

22 Credit carryover (from Schedule H) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 22

23 Research Credit (from Schedule RC) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 23

24 Harbor Maintenance Tax Credit (from Schedule HM, line 20) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 24

25 Full Employment Credit (from Schedule FEC, line 27) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 25

26 Brownfields Credit. Certificate number 3

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 26

27 Low-Income Housing Credit (enclose documentation) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 27

28 Historic Rehabilitation Credit (enclose documentation) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 28

29 Home Energy Efficiency Credit (enclose documentation) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 29

30 Solar Heat Credit (enclose documentation) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 30

31 Film Incentive Credit. Certificate number 3

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 31

32 Medical Device Credit. Certificate number 3

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 32

33 Total credits. Add lines 19 through 32 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 33

Under the penalties of perjury, I declare that to the best of my knowledge and belief, this return and enclosures are true, correct and complete.

Signature of appropriate corporate officer (see instructions)

Social Security number

Telephone number

Date

Signature of paid preparer

Employer Identification number

Address

Date

If you are signing as an authorized delegate of the appropriate corporate officer, check here

and enclose Massachusetts Form M-2848, Power of Attorney.

The Privacy Act Notice is available upon request. Mail to: Massachusetts Department of Revenue, PO Box 7067, Boston, MA 02204.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2