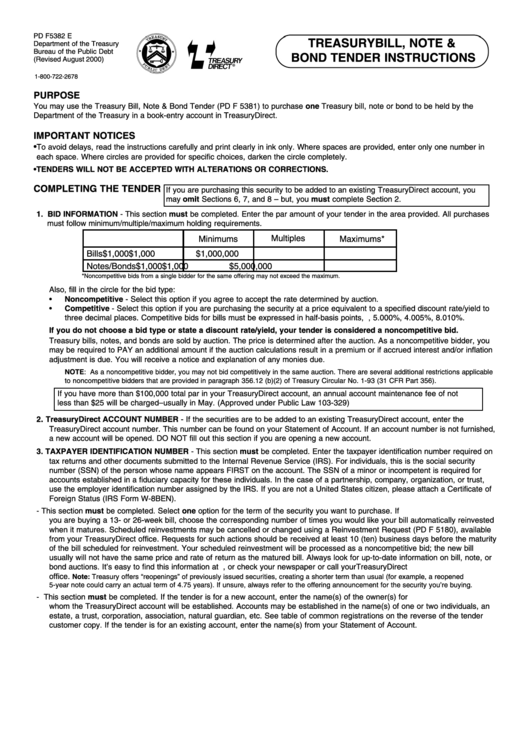

Instructions For Form Pd F 5382 E Treasury Bill, Note & Bond Tender

ADVERTISEMENT

PD F 5382 E

TREASURY BILL, NOTE &

Department of the Treasury

Bureau of the Public Debt

BOND TENDER INSTRUCTIONS

(Revised August 2000)

1-800-722-2678

PURPOSE

You may use the Treasury Bill, Note & Bond Tender (PD F 5381) to purchase one Treasury bill, note or bond to be held by the

Department of the Treasury in a book-entry account in TreasuryDirect.

IMPORTANT NOTICES

•

To avoid delays, read the instructions carefully and print clearly in ink only. Where spaces are provided, enter only one number in

each space. Where circles are provided for specific choices, darken the circle completely.

•TENDERS WILL NOT BE ACCEPTED WITH ALTERATIONS OR CORRECTIONS.

COMPLETING THE TENDER

If you are purchasing this security to be added to an existing TreasuryDirect account, you

may omit Sections 6, 7, and 8 – but, you must complete Section 2.

1. BID INFORMATION - This section must be completed. Enter the par amount of your tender in the area provided. All purchases

must follow minimum/multiple/maximum holding requirements.

Multiples

Minimums

Maximums*

Bills

$1,000

$1,000

$1,000,000

Notes/Bonds

$1,000

$1,000

$5,000,000

*Noncompetitive bids from a single bidder for the same offering may not exceed the maximum.

Also, fill in the circle for the bid type:

•

Noncompetitive - Select this option if you agree to accept the rate determined by auction.

•

Competitive - Select this option if you are purchasing the security at a price equivalent to a specified discount rate/yield to

three decimal places. Competitive bids for bills must be expressed in half-basis points, e.g., 5.000%, 4.005%, 8.010%.

If you do not choose a bid type or state a discount rate/yield, your tender is considered a noncompetitive bid.

Treasury bills, notes, and bonds are sold by auction. The price is determined after the auction. As a noncompetitive bidder, you

may be required to PAY an additional amount if the auction calculations result in a premium or if accrued interest and/or inflation

adjustment is due. You will receive a notice and explanation of any monies due.

NOTE: As a noncompetitive bidder, you may not bid competitively in the same auction. There are several additional restrictions applicable

to noncompetitive bidders that are provided in paragraph 356.12 (b)(2) of Treasury Circular No. 1-93 (31 CFR Part 356).

If you have more than $100,000 total par in your TreasuryDirect account, an annual account maintenance fee of not

less than $25 will be charged–usually in May. (Approved under Public Law 103-329)

.

2

TreasuryDirect ACCOUNT NUMBER - If the securities are to be added to an existing TreasuryDirect account, enter the

TreasuryDirect account number. This number can be found on your Statement of Account. If an account number is not furnished,

a new account will be opened. DO NOT fill out this section if you are opening a new account.

3. TAXPAYER IDENTIFICATION NUMBER - This section must be completed. Enter the taxpayer identification number required on

tax returns and other documents submitted to the Internal Revenue Service (IRS). For individuals, this is the social security

number (SSN) of the person whose name appears FIRST on the account. The SSN of a minor or incompetent is required for

accounts established in a fiduciary capacity for these individuals. In the case of a partnership, company, organization, or trust,

use the employer identification number assigned by the IRS. If you are not a United States citizen, please attach a Certificate of

Foreign Status (IRS Form W-8BEN).

4. TERM SELECTION - This section must be completed. Select one option for the term of the security you want to purchase. If

you are buying a 13- or 26-week bill, choose the corresponding number of times you would like your bill automatically reinvested

when it matures. Scheduled reinvestments may be cancelled or changed using a Reinvestment Request (PD F 5180), available

from your TreasuryDirect office. Requests for such actions should be received at least 10 (ten) business days before the maturity

of the bill scheduled for reinvestment. Your scheduled reinvestment will be processed as a noncompetitive bid; the new bill

usually will not have the same price and rate of return as the matured bill. Always look for up-to-date information on bill, note, or

bond auctions. It’s easy to find this information at , or check your newspaper or call your TreasuryDirect

office.

Note: Treasury offers “reopenings” of previously issued securities, creating a shorter term than usual (for example, a reopened

5-year note could carry an actual term of 4.75 years). If unsure, always refer to the offering announcement for the security you’re buying.

5. ACCOUNT NAME - This section must be completed. If the tender is for a new account, enter the name(s) of the owner(s) for

whom the TreasuryDirect account will be established. Accounts may be established in the name(s) of one or two individuals, an

estate, a trust, corporation, association, natural guardian, etc. See table of common registrations on the reverse of the tender

customer copy. If the tender is for an existing account, enter the name(s) from your Statement of Account.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2