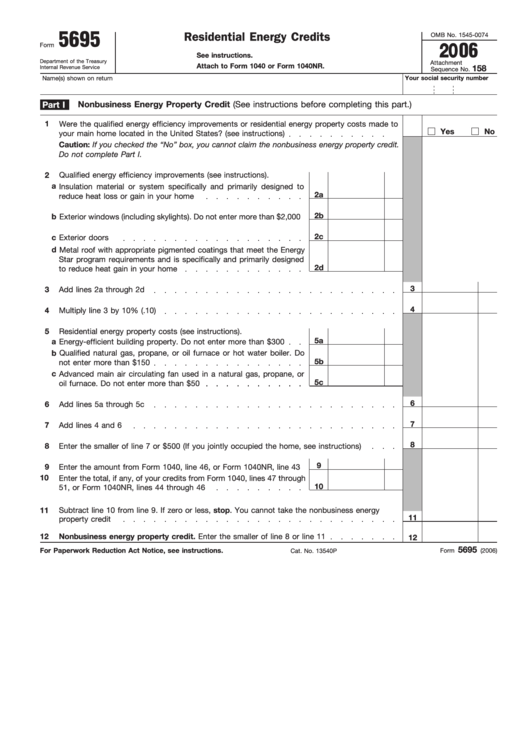

5695

Residential Energy Credits

OMB No. 1545-0074

Form

2006

See instructions.

Department of the Treasury

Attachment

Attach to Form 1040 or Form 1040NR.

Internal Revenue Service

158

Sequence No.

Name(s) shown on return

Your social security number

Nonbusiness Energy Property Credit (See instructions before completing this part.)

Part I

1

Were the qualified energy efficiency improvements or residential energy property costs made to

Yes

No

your main home located in the United States? (see instructions)

Caution: If you checked the “No” box, you cannot claim the nonbusiness energy property credit.

Do not complete Part I.

2

Qualified energy efficiency improvements (see instructions).

a Insulation material or system specifically and primarily designed to

2a

reduce heat loss or gain in your home

2b

b Exterior windows (including skylights). Do not enter more than $2,000

2c

c Exterior doors

d Metal roof with appropriate pigmented coatings that meet the Energy

Star program requirements and is specifically and primarily designed

2d

to reduce heat gain in your home

3

3

Add lines 2a through 2d

4

4

Multiply line 3 by 10% (.10)

5

Residential energy property costs (see instructions).

5a

a Energy-efficient building property. Do not enter more than $300

b Qualified natural gas, propane, or oil furnace or hot water boiler. Do

5b

not enter more than $150

c Advanced main air circulating fan used in a natural gas, propane, or

5c

oil furnace. Do not enter more than $50

6

6

Add lines 5a through 5c

7

7

Add lines 4 and 6

8

8

Enter the smaller of line 7 or $500 (If you jointly occupied the home, see instructions)

9

9

Enter the amount from Form 1040, line 46, or Form 1040NR, line 43

10

Enter the total, if any, of your credits from Form 1040, lines 47 through

10

51, or Form 1040NR, lines 44 through 46

11

Subtract line 10 from line 9. If zero or less, stop. You cannot take the nonbusiness energy

11

property credit

12

Nonbusiness energy property credit. Enter the smaller of line 8 or line 11

12

5695

For Paperwork Reduction Act Notice, see instructions.

Cat. No. 13540P

Form

(2006)

1

1 2

2