Form Ab-231 Instructions - Wisconsin Liquor Tax Multiple Schedule Page 2

ADVERTISEMENT

discovered to be damaged after being released from US Customs

SPECIFIC INSTRUCTIONS FOR

or received from a supplier.

OUT-OF-STATE PERMITTEES

Enter the totals of your untaxed credits on line 8 of AB-130.

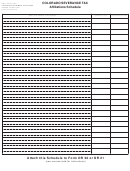

SALES SCHEDULES (use a single line for each invoice)

Permittees located outside Wisconsin will use the multiple schedule

Tax-Paid Credits – Schedule 4

to report only those sales made to permittees in Wisconsin. Sales

Itemize all tax-paid products found to be short shipped, lost or broken

are reportable in the month that actual physical movement of the

prior to your receipt of the tax-paid merchandise from a supplier.

merchandise takes place from a shipper’s premise.

This schedule may also be used to report documented breakage

taking place on your premises, as well as merchandise discovered

Remember to group all sales by customer name and location and

to be damaged after its receipt.

to provide a subtotal for each customer. Also enter the customer’s

Wisconsin permit number in column C.

Enter the totals of your tax-paid credits on line 20 of AB-130.

Untaxed Sales – Schedule 5

SALES SCHEDULES (use a single line for each invoice)

Itemize all sales of untaxed products shipped during the month into

Sales are reportable in the month that actual physical movement of

Wisconsin where the liquor taxes, if applicable, are the responsibility

the merchandise takes place from a wholesaler’s (shipper) premise.

of the Wisconsin permittee. Examples of untaxed sales:

Out-of-State Shipments - Wisconsin permittees shipping untaxed

1.

Sales of bulk spirits to rectifiers.

or tax-paid merchandise to other states must attach the AB-150

2.

Sales of alcohol to industrial and medicinal alcohol

(Shipments of Alcohol Beverages to Customers in Other States) to

permittees.

their AB-130. A separate AB-150 must be prepared and submitted

3.

Sales of bulk wine to bottlers, rectifiers and wineries.

in duplicate for each state to which shipments are made. The

4.

Sales of sacramental wine to manufacturers, rectifiers and

department mails copies of these schedules to the various states

wholesalers having a permit.

receiving shipments.

5.

Sales of wine to industrial wine permittees.

6.

Sales of spirits, cider or wine that will be received in

Untaxed Sales – Schedule 5

Wisconsin through US Customs and the Wisconsin

Itemize all sales of untaxed products made during the month to

permittee is designated as the “importer of record.”

Wisconsin permittees or shipped out-of-state. Be sure that persons

receiving untaxed merchandise in Wisconsin have the appropriate

Be sure that the person you are shipping untaxed merchandise to

permit to purchase merchandise tax-free. Enter that customer’s

in Wisconsin has the proper permit to purchase merchandise tax-

Wisconsin permit number in column C.

free. Enter that customer’s Wisconsin permit number in column

C.

Totaling Untaxed Sales - On the bottom of each untaxed sales

schedule, indicate totals for columns D, E. F and G. In addition, on

Totaling Untaxed Sales - On the bottom of each untaxed sales

your last schedule provide (and label) grand totals for “total out-of-

schedule, indicate the total for columns D, E, F & G. On your last

state shipments” and “total sales in Wisconsin.”

untaxed sales schedule, also provide grand totals for each column.

Do not enter these totals in Section 1 on your AB-130 because that

Enter the totals of you untaxed out-of-state shipments on line 6 of

section only applies to in-state (Wisconsin based) permittees.

AB-130. The totals of your untaxed Wisconsin sales should be

entered on line 7 of AB-130.

Tax-Paid Sales – Schedule 6

Itemize all sales of tax-paid products sold to Wisconsin wholesalers

Tax-Paid Sales – Schedule 6

for which you are responsible for paying the Wisconsin distilled

Itemize all sales of tax-paid products whether sold to Wisconsin

spirits, apple cider and wine taxes. Sales include all sample

wholesalers or shipped out-of-state. Sales to Wisconsin retailers

products entering Wisconsin via your Wisconsin distributors or

need not be itemized.

picked up directly at your location by your own salespersons and

taken to Wisconsin.

Totaling Tax-Paid Sales - On your last tax-paid sales schedule

provide (and label) these four grand totals:

Totaling Tax-Paid Sales - On your last tax-paid sales schedule,

provide a total for each column of sales to Wisconsin wholesalers.

• Total out-of-state shipments

Enter the total amounts on line 19 of AB-130.

• Total sales to retailers

• Total sales to wholesalers

CORRECTIONS TO PRIOR MONTHS SALES

• Total Wisconsin sales (total of sales to retailers &

Sales reported on prior months’ sales schedules may require

wholesalers)

correction because merchandise shipped to Wisconsin customers

is found to have been shipped short, or lost or broken in transit to

Enter the totals of your out-of-state shipments on line 18 of AB-

that customer. To correct a prior month’s entry, follow these steps:

130. The totals of your Wisconsin sales should be entered on line

19 of AB-130.

1.

Enter the previous month’s incorrect entry in its entirety on

the current month’s sales schedule.

Credit for Sales of Tax-Paid Merchandise to Out-of-State Customers

2.

Circle the liter amount of this entry.

or to Sacramental Wine Permittees - If you ship tax-paid distilled

3.

Place the correct entry on the line immediately below the

spirits, cider and/or wine out-of-state or sell tax-paid wine to a

incorrect entry.

sacramental wine permittee, you are entitled to a refund of the

4.

Indicate in column C the reason for this correction.

Wisconsin beverage tax you paid on the merchandise. To obtain a

5.

Deduct the circled amounts when you compute the subtotals

refund, send us a copy of the invoice and bill of lading along with a

and grand totals on your sales schedules.

letter that contains a calculation of the refund you have coming.

You may send your request with your monthly return or separately.

Although these shipments must be itemized on your monthly return,

DO NOT claim the refund on that return. Your refund request must

be processed separately from your monthly return.

2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2