Reset Form

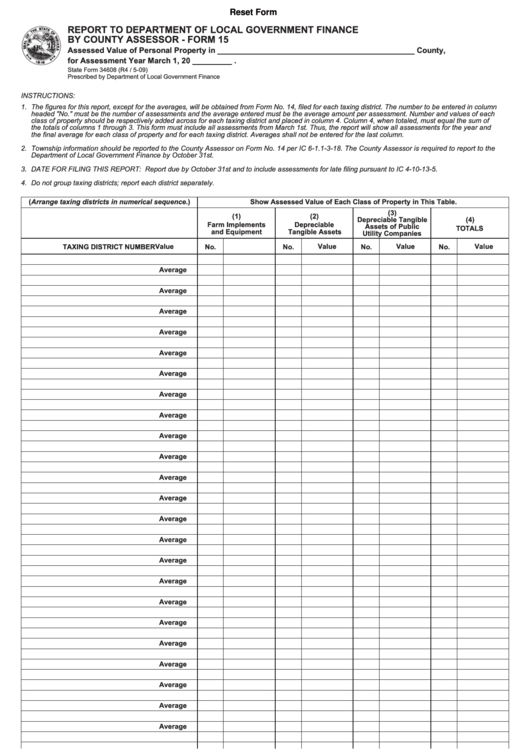

REPORT TO DEPARTMENT OF LOCAL GOVERNMENT FINANCE

BY COUNTY ASSESSOR - FORM 15

Assessed Value of Personal Property in _____________________________________________ County,

for Assessment Year March 1, 20 _________ .

State Form 34608 (R4 / 5-09)

Prescribed by Department of Local Government Finance

INSTRUCTIONS:

1.

The figures for this report, except for the averages, will be obtained from Form No. 14, filed for each taxing district. The number to be entered in column

headed "No." must be the number of assessments and the average entered must be the average amount per assessment. Number and values of each

class of property should be respectively added across for each taxing district and placed in column 4. Column 4, when totaled, must equal the sum of

the totals of columns 1 through 3. This form must include all assessments from March 1st. Thus, the report will show all assessments for the year and

the final average for each class of property and for each taxing district. Averages shall not be entered for the last column.

2.

Township information should be reported to the County Assessor on Form No. 14 per IC 6-1.1-3-18. The County Assessor is required to report to the

Department of Local Government Finance by October 31st.

3.

DATE FOR FILING THIS REPORT: Report due by October 31st and to include assessments for late filing pursuant to IC 4-10-13-5.

4.

Do not group taxing districts; report each district separately.

(Arrange taxing districts in numerical sequence.)

Show Assessed Value of Each Class of Property in This Table.

(3)

(1)

(2)

Depreciable Tangible

(4)

Farm Implements

Depreciable

Assets of Public

TOTALS

and Equipment

Tangible Assets

Utility Companies

TAXING DISTRICT NUMBER

No.

Value

No.

Value

No.

Value

No.

Value

Average

Average

Average

Average

Average

Average

Average

Average

Average

Average

Average

Average

Average

Average

Average

Average

Average

Average

Average

Average

Average

Average

Average

Average

Average

TOTAL

AVERAGE

I hereby certify the above report to be full, true and complete this ________ day of _____________________________ , 20________.

Signature of County Assessor

Printed name of County Assessor

Date signed (month, day, year)

1

1