California Form 3587 - Payment Voucher For Lp, Llp, And Remic E-Filed Returns - 2007

ADVERTISEMENT

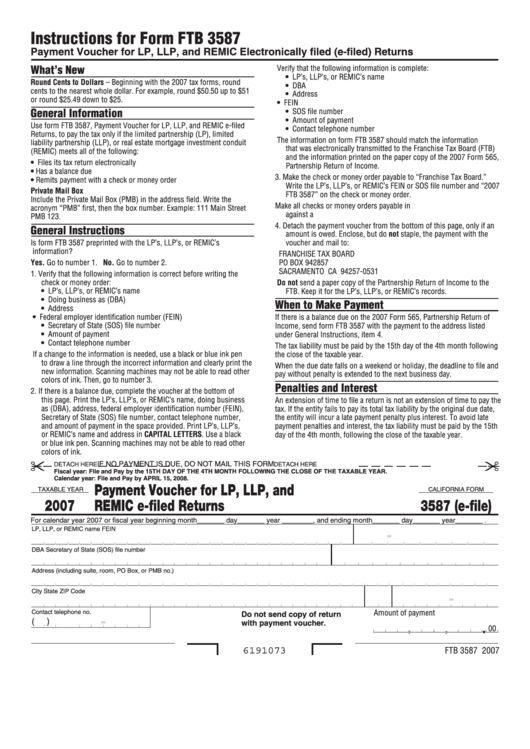

Instructions for Form FTB 3587

Payment Voucher for LP, LLP, and REMIC Electronically filed (e-filed) Returns

What’s New

Verify that the following information is complete:

• LP’s, LLP’s, or REMIC’s name

Round Cents to Dollars – Beginning with the 2007 tax forms, round

• DBA

cents to the nearest whole dollar. For example, round $50.50 up to $51

• Address

or round $25.49 down to $25.

• FEIN

General Information

• SOS file number

• Amount of payment

Use form FTB 3587, Payment Voucher for LP, LLP, and REMIC e-filed

• Contact telephone number

Returns, to pay the tax only if the limited partnership (LP), limited

The information on form FTB 3587 should match the information

liability partnership (LLP), or real estate mortgage investment conduit

that was electronically transmitted to the Franchise Tax Board (FTB)

(REMIC) meets all of the following:

and the information printed on the paper copy of the 2007 Form 565,

• Files its tax return electronically

Partnership Return of Income.

• Has a balance due

3. Make the check or money order payable to “Franchise Tax Board.”

• Remits payment with a check or money order

Write the LP’s, LLP’s, or REMIC’s FEIN or SOS file number and “2007

Private Mail Box

FTB 3587” on the check or money order.

Include the Private Mail Box (PMB) in the address field. Write the

Make all checks or money orders payable in U.S. dollars and drawn

acronym “PMB” first, then the box number. Example: 111 Main Street

against a U.S. financial institution.

PMB 123.

4. Detach the payment voucher from the bottom of this page, only if an

General Instructions

amount is owed. Enclose, but do not staple, the payment with the

Is form FTB 3587 preprinted with the LP’s, LLP’s, or REMIC’s

voucher and mail to:

information?

FRANCHISE TAX BOARD

Yes. Go to number 1.

No. Go to number 2.

PO BOX 942857

SACRAMENTO CA 94257-0531

1. Verify that the following information is correct before writing the

check or money order:

Do not send a paper copy of the Partnership Return of Income to the

• LP’s, LLP’s, or REMIC’s name

FTB. Keep it for the LP’s, LLP’s, or REMIC’s records.

• Doing business as (DBA)

When to Make Payment

• Address

• Federal employer identification number (FEIN)

If there is a balance due on the 2007 Form 565, Partnership Return of

• Secretary of State (SOS) file number

Income, send form FTB 3587 with the payment to the address listed

• Amount of payment

under General Instructions, item 4.

• Contact telephone number

The tax liability must be paid by the 15th day of the 4th month following

If a change to the information is needed, use a black or blue ink pen

the close of the taxable year.

to draw a line through the incorrect information and clearly print the

When the due date falls on a weekend or holiday, the deadline to file and

new information. Scanning machines may not be able to read other

pay without penalty is extended to the next business day.

colors of ink. Then, go to number 3.

Penalties and Interest

2. If there is a balance due, complete the voucher at the bottom of

this page. Print the LP’s, LLP’s, or REMIC’s name, doing business

An extension of time to file a return is not an extension of time to pay the

as (DBA), address, federal employer identification number (FEIN),

tax. If the entity fails to pay its total tax liability by the original due date,

Secretary of State (SOS) file number, contact telephone number,

the entity will incur a late payment penalty plus interest. To avoid late

and amount of payment in the space provided. Print LP’s, LLP’s,

payment penalties and interest, the tax liability must be paid by the 15th

or REMIC’s name and address in CAPITAL LETTERS. Use a black

day of the 4th month, following the close of the taxable year.

or blue ink pen. Scanning machines may not be able to read other

colors of ink.

IF NO PAYMENT IS DUE, DO NOT MAIL THIS FORM

DETACH HERE

DETACH HERE

Fiscal year: File and Pay by the 15th Day oF thE 4th Month FoLLowIng thE CLosE oF thE taxabLE yEaR.

Calendar year: File and Pay by aPRIL 15, 2008.

Payment Voucher for LP, LLP, and

TAXABLE YEAR

CALIFORNIA FORM

2007

REMIC e-filed Returns

3587 (e-file)

For calendar year 2007 or fiscal year beginning month_______ day_______ year ________, and ending month_______ day_______ year_______ .

LP, LLP, or REMIC name

FEIN

-

DBA

Secretary of State (SOS) file number

Address (including suite, room, PO Box, or PMB no.)

City

State

ZIP Code

-

Amount of payment

Contact telephone no.

Do not send copy of return

-

(

)

with payment voucher.

.

00

,

,

FTB 3587 2007

6191073

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1